This Sunday, Celtic Park will play host to the first Old Firm Derby of the 2024/25 campaign.

Reigning Scottish champions Celtic will face off at home against bitter rivals Rangers four games into the Premiership season.

Thus far, Brendan Rodgers’ side have got a flawless record in the league with three wins from three, equalling nine points; the Bhoys have also scored nine goals and conceded zero in an impressive opening three league games.

On the opposite side, while Philippe Clement’s Gers are still unbeaten in the league this season, they did drop two points in matchday one against Hearts.

This means they enter this Sunday’s game in third place, trailing their Glasgow foes by two points.

While all eyes will be planted firmly on the pitch this Sunday, these two clubs battle in plenty of ways off the pitch, too, including in terms of their recruitment, which plays an absolutely vital role in preparing any club for the season ahead and giving the coaching staff the tools they need to achieve their goals.

This data analysis piece will delve into the data and statistics to provide some insight into both of these teams’ respective approaches to recruitment in recent years, leading up to where we find them and their squads today ahead of their upcoming contest.

Our analysis focuses on the way in which these two clubs have composed their current first-team squads, where Celtic have succeeded in recent years and where Rangers need to improve.

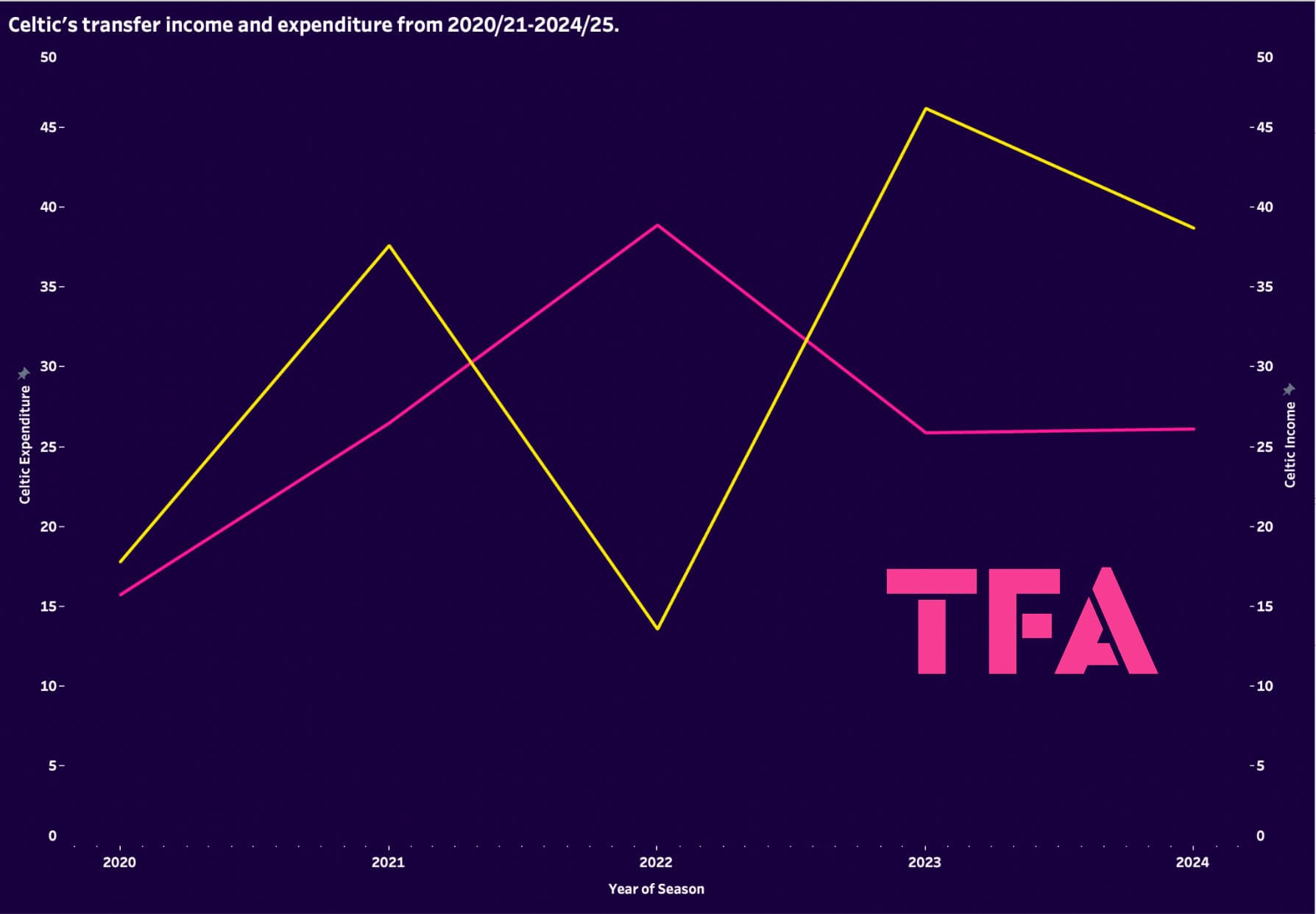

Celtic & Rangers Transfer Income And Expenditure

We’ll start by focusing on these two clubs’ respective recent transfer income and expenditure.

We’ll begin by focusing on the current Scottish champions who have won three of the last four Premiership titles, two of the last four Scottish Cups and two of the last four Scottish League Cups from the 2020/21 season to the current campaign — the same time period we’re centring on for our data analysis.

With the exception of 2022/23 — the second year of Ange Postecoglou’s tenure at Parkhead — Celtic’s income has been above their expenditure due to past transfer investments paying off and allowing the club to reinvest healthily.

The sales Celtic made during this period include Jeremie Frimpong (signed from Manchester City for €380k, sold to Bayer Leverkusen for €11m), Odsonne Édouard (signed from PSG for €10.3m, sold to Crystal Palace for €16.3m), Kristoffer Ajer (signed from Start for €600k, sold to Brentford for €15.7m), Jota (signed from Benfica for €16.2m, sold to Al-Ittihad for €29.1m) and Matt O’Riley (signed from MK Dons for €1.8m, sold to Brighton and Hove Albion for €29.5m).

All of these deals equal a transfer profit of €72.32m for Celtic, so they could easily afford to back Postecoglou in the market when they opted to do so.

A noticeable surge in income the following year was a direct result of their investment in Jota the year prior, as he was sold for €29.1m.

These figures also don’t factor in the key role the likes of the aforementioned ex-Celtic squad members had to play in the club’s success during this period.

All in all, the Hoops have a very healthy recruitment model that tends to keep the quality within the squad high enough to compete where they want to compete domestically while also consistently generating a net transfer profit.

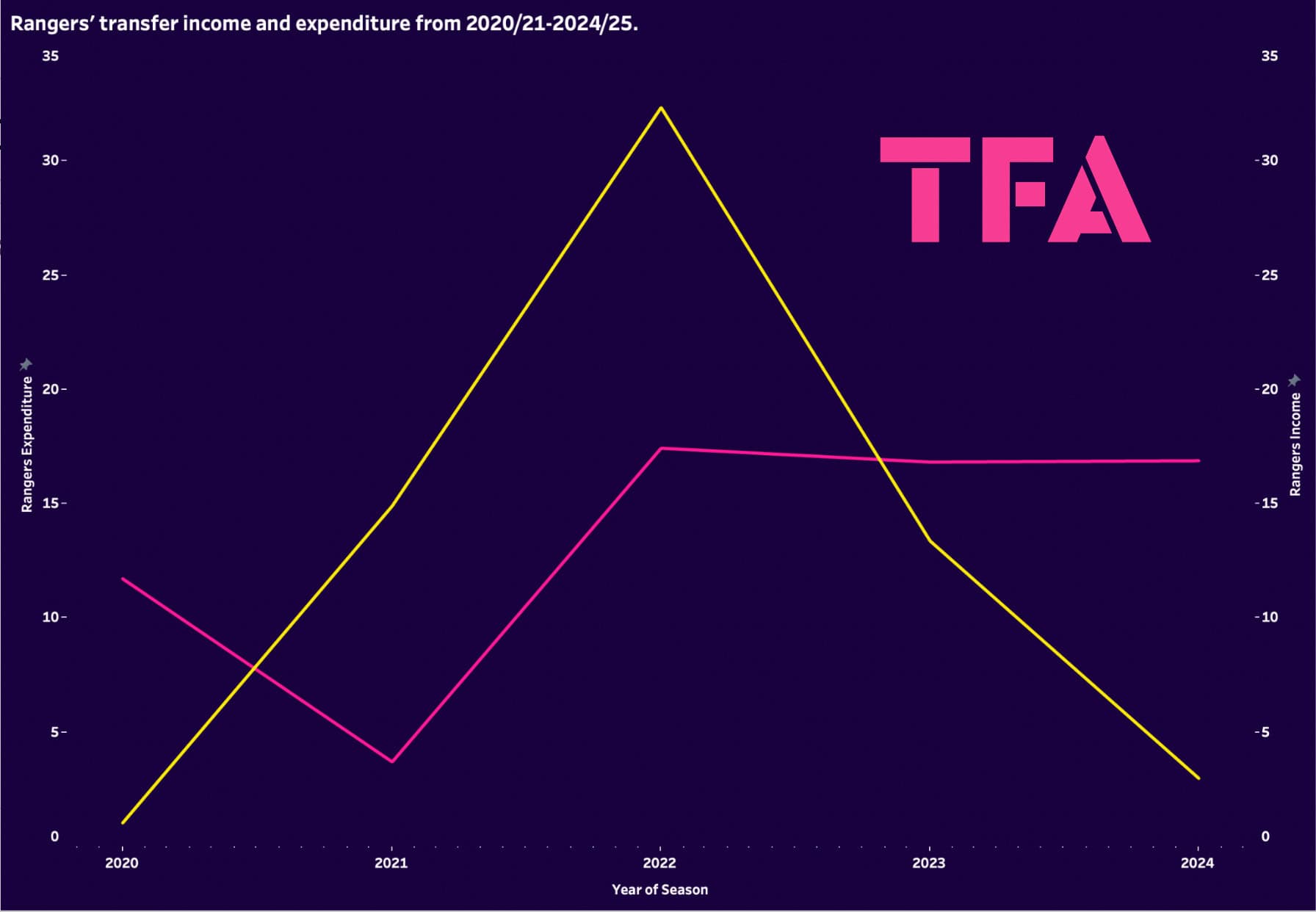

Now let’s move on to Rangers, who have won one Premiership title, one Scottish Cup and one Scottish League Cup during this timeframe.

Overall, the Gers’ transfer activity has been less impressive, with the club generating a mild net transfer loss of €1.95m from 2020/21 to the current campaign at the time of writing.

Rangers are in a different place to Celtic at the moment financially, hence their difficulty in consistently preventing their rivals from winning the league and the smaller numbers we see them dealing with in figure 2 compared to figure 1.

Still, the Gers are always in or around where they’d want to be in the league despite spending a lot less than Celtic in every transfer window from our time period.

With lower investment come lower returns for Rangers, as only in the 2022/23 campaign when they offloaded Calvin Bassey to Ajax for €23m — a transfer profit of €23m as he was initially signed on a free from Leicester City — and Joe Aribo to Southampton for €7.1m — another who joined the Glasgow giants for nothing.

This is an example of Rangers’ top-class recruitment despite the stricter financial constraints they’ve been under.

They’ve shown a keen ability to get deals over the line by selling the club, the platform it provides players and the way in which it can develop talent. They’ve also supported that by propelling the likes of Bassey and Aribo to the next step(s) in their respective careers.

Stories like these are vital for a club that wants to acquire talent that would have them competing at the very top of their domestic division but don’t exactly have the finances to go blow for blow with their competition.

In such situations, clubs need to find an alternative edge, but the history of football shows that the biggest spenders tend to be unbeatable over the long run.

Still, Rangers’ wise investments paid off with a league win and success in each of their two domestic cups.

They also tend to push their rivals Celtic quite closely in the title race during this period, which is a testament to the work the likes of now-ex-Sporting Director Ross Wilson (currently at Nottingham Forest since leaving Rangers in April 2023) achieved from a squad-building standpoint.

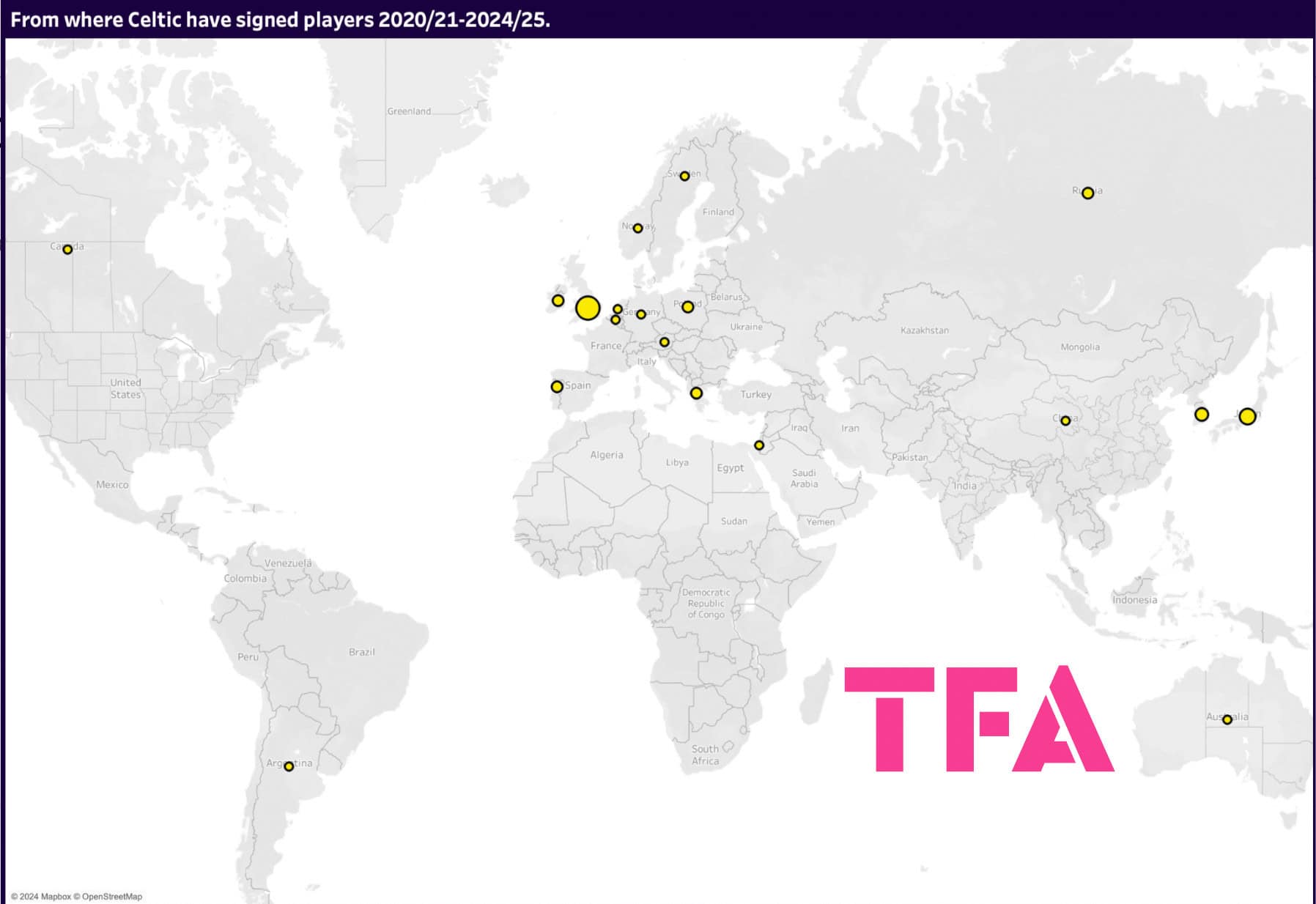

Celtic’s Recruitment Markets

So the next question is: how have Celtic composed their squad?

Where have they spent their money wisely?

Ange Postecoglou’s tenure as Celtic manager lasted two years — from the summer of 2021 to summer 2023.

At that time, Celtic began branching out with their recruitment significantly into Asian markets like Japan, South Korea, and China—particularly the former two, from which a combined total of eight players were signed on permanent deals at some point during this timeframe.

As of the time of writing, this season is the first one since 2020/21 in which Celtic haven’t dipped into Asia for any new additions to the squad.

Out of their current squad of 27 players, five have entered the first team directly from the academy, equalling just under a fifth of the squad; per Transfermarkt, the market value of these five academy products is €12.6m — just over 10% of the squad’s total market value.

That doesn’t include James McCarthy, although he is from Celtic’s academy.

He was most recently re-signed from Crystal Palace, making him one of eight players to have joined the current Celtic squad from other sides in the UK—just under 30% of the first team.

Nine of the 27 Celtic first-teamers have joined from other European nations — precisely a third of the team, which is Celtic’s most heavily used market, though no one European country in particular dominates the map, with a couple of signings from Ireland during the period analysed — unsurprising given Celtic’s historical connection with the neighbouring island — as well as two from Portugal, Greece and Poland in addition to one from each of the other European countries highlighted on our map of signings.

The current Celtic squad has four players signed from Asian sides — slightly less than 15% of the squad — with the last player having joined from CF Montréal.

Three of Celtic’s players signed from Japan remain at the club today, and each individual’s value has skyrocketed during their time at Parkhead.

Kyogo Furuhashi was signed for €5.4m in 2021, valued at €2m at the time, according to Transfermarkt, who now value him at €14m.

Reo Hatate was signed for €1.53m in January 2022, then valued at €800k by Transfermarkt, who now value him at €10m.

Meanwhile, Daizen Maeda joined the Hoops in July 2022 for €1.53m when valued at €1.1m by Transfermarkt, where he’s now valued at €7m.

These are three major success stories of Celtic’s recent recruitment in Asia.

Although not every signing from the continent has been successful during this time period — they have probably had more misses than hits — the successes are far greater in profit than the failures are in loss, meaning that it’s been well worth it for the club to take the chances they’ve taken in branching out with their recruitment and thinking outside the box in this period both off the pitch and on it, with the likes of the aforementioned three Japanese players remaining at Parkhead having played crucial roles in Celtic’s recent domestic success.

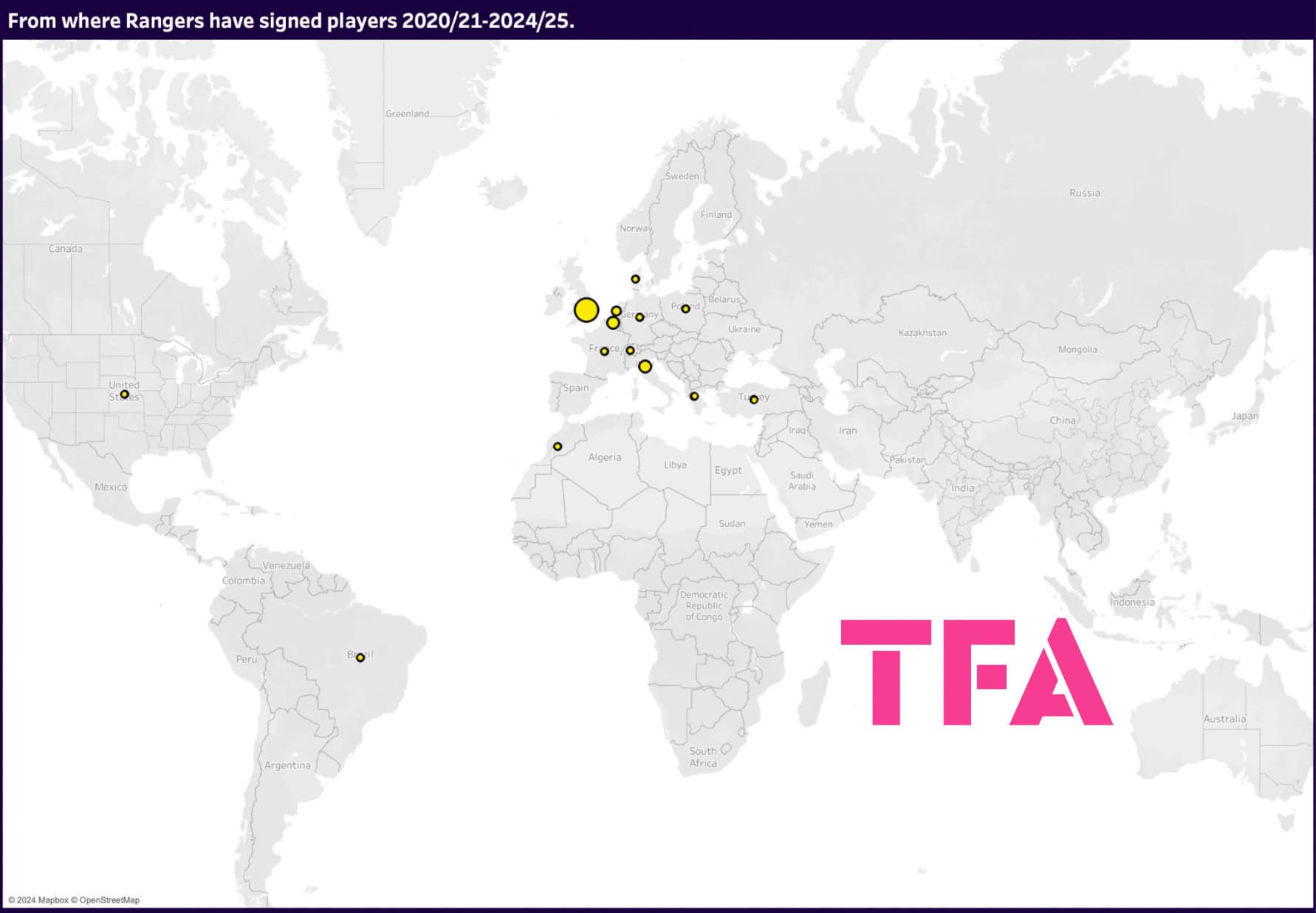

Rangers’ Recruitment Markets

In contrast to Celtic, Rangers have not typically looked that far from home for their signings in recent times.

While Celtic have shopped in 19 different countries for player acquisitions during this period, the Gers have only dipped into 14 different areas, keeping their recruitment far more localised.

Similarly, while Celtic have signed two or more players from eight different countries over the last five seasons, 2024/25 inclusive, Rangers have brought two or more players in from exactly half that number.

England and Scotland have been Rangers’ primary hunting grounds for talent, with 19 players going to Ibrox from the UK.

Four have joined Rangers from Italy and Belgium, respectively, while two have moved to Glasgow from the Netherlands.

Of Rangers’ current 29-man squad, over a third (10) have been signed from other clubs within the UK — six from England, four from Scotland — while four players or 13.8% progressed to Rangers’ first team from the academy.

Like Celtic, European markets have been used to comprise the highest portion of Rangers’ squad — 13 of their 29 first-teamers (44.8%).

Rangers have used the markets of the Netherlands (three), Italy (three), and Germany (two) to sign at least two players for their current 29-man first team.

The remaining two players joined from Brazil and Morocco, respectively.

According to Transfermarkt’s valuations, Rangers’ four academy products in the first team have a combined value of €2.1m — just over 2.5% of the team’s total market value.

The value of Rangers’ academy products relative to their first-team squad is about a quarter of Celtic’s, signalling that the Parkhead outfit is currently ahead of their local rivals in the homegrown players department.

However, it’s also important to note that more than two-thirds of Celtic’s academy product value is contributed by 31-year-old Callum McGregor, who’s a long way removed from the youth system.

So, this may not be as glowing an appraisal of Celtic’s current ability to produce youth talent as it seems at first glance, and their current ability to do so consistently does have question marks over it.

Still, it’s certain that Rangers can also significantly improve their current ability to bring youth through their ranks and into the first team.

Should they invest heavily in their youth academy now, this could be an area for significant growth and potential gains over their domestic rivals in the future.

Conclusion

To conclude our data analysis focusing on the recent recruitment trends of Celtic and Rangers, it’s clear that Celtic have been both more adventurous and successful in their transfer exploits over the past five years, with Rangers currently playing catch-up.

The key for Rangers to turn the tables on their rivals will be to implement sustainable practices that can both provide the first team with a boost of talent to keep the level on the pitch high while also finding a way to generate consistent profit — this is the challenge for new Head of Scouting Nils Koppen and manager Philippe Clement.

They’ve shown an ability to pull off some great one-off deals that yield substantial transfer profit, but they haven’t always been able to replicate those deals.

Finding a way of doing that, whether it’s via an improved youth system that consistently generates first-team-level talent or finding a niche market in which they can strike gold akin to Celtic with Japan, should now be a high priority for the Gers.

Comments