As the 2024/25 Ligue 1 season kicks off, the battling between clubs will shift from being primarily conducted behind the scenes as each team tries to prepare themselves as best they can for the campaign ahead to taking place on the pitch when the squads that each competitor has assembled will be put to the test against one another.

The season provides us — and the teams themselves — with a fantastic opportunity to assess each team’s respective work behind the scenes during the transfer window and judge their ability to create a squad of the necessary standard to achieve their respective goals in the 2024/25 campaign.

Two teams that will probably be entering the new season with relatively similar goals are Lille and Lyon, who finished fourth and sixth, respectively, in Ligue 1 last time around.

Both of these sides are staples of the French top-flight and both will be hoping to push for UEFA Champions League football in 2025/26 through their league position in 2024/25.

However, both teams have approached the process of recruitment in contrasting ways this summer, with the two sides on very different stages of their respective journeys at the moment.

This Ligue 1 recruitment analysis piece will use data and statistics to provide some analysis of the work that Lille, under the leadership of their ‘Director of Professional Football’ Franck Béria and ‘Sports Coordinator’ Sylvain Armand, have done to prepare their squad for the 2024/25 campaign.

This is also their first campaign under new manager Bruno Génésio, who similar to Lyon in their first summer under ‘Sporting Director’ Friio, had approached bolstering their squad for manager Pierre Sage.

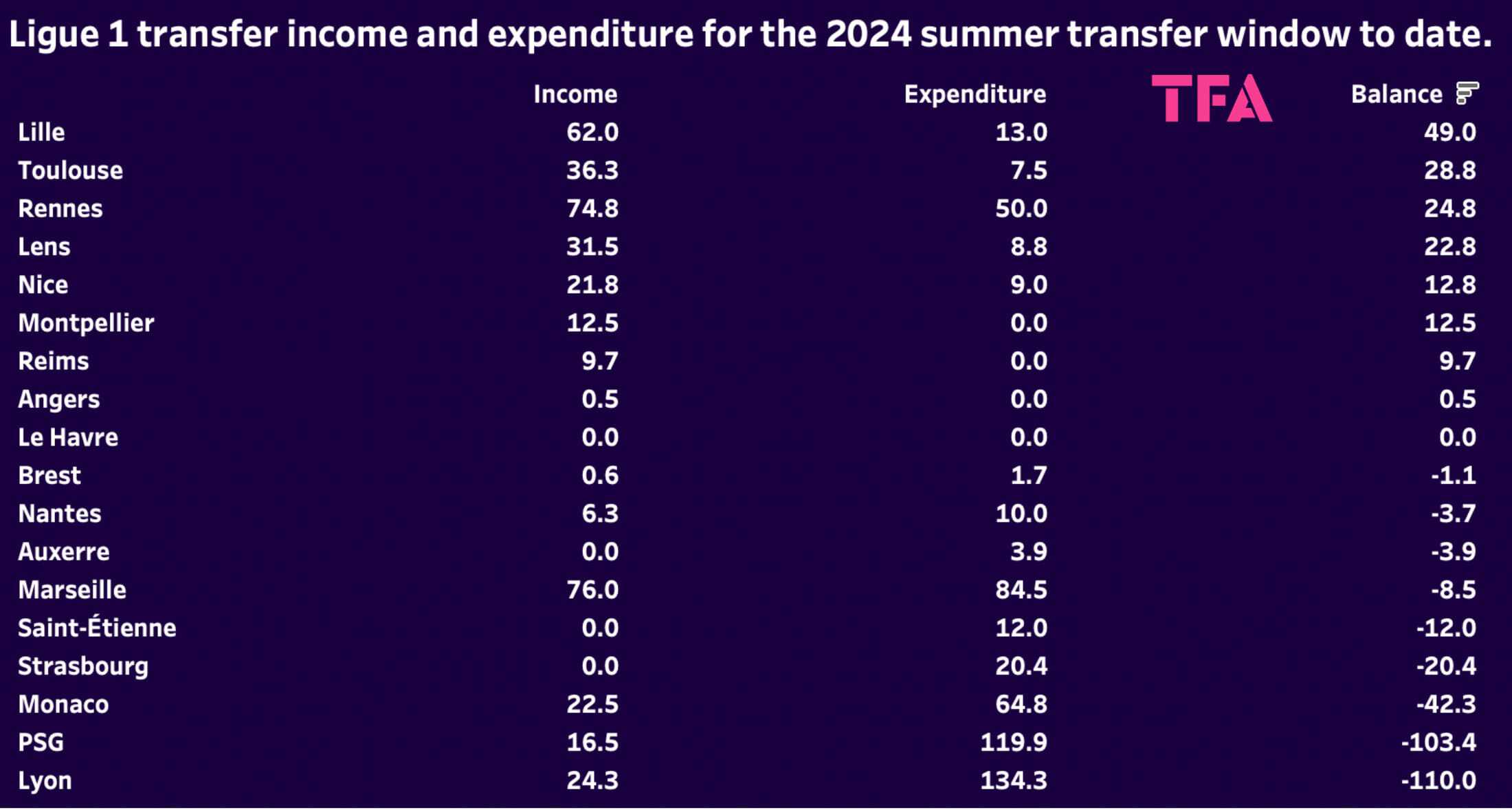

Ligue 1 Summer Transfer Window Overview

It’s worth reiterating that at the time of writing this piece, the 2024 summer transfer window has not yet officially concluded, so the numbers we analyse here are not 100% final.

However, they do still provide us with a clear insight into the recruitment approach of both Lyon and Lille, in the current stages of their respective projects.

Turning our attention to figure 1, the stark contrast between Lille and Lyon’s transfer strategies becomes immediately apparent, with Lille the most profitable team in the league, at the time of writing, in the summer transfer window and Lyon with the biggest net spend.

Lyon’s €134.3m spent on transfers this summer has been spread among eight new arrivals.

These signings are Moussa Niakhaté (€31.9m) and Orel Mangala (€23.4m) from Nottingham Forest, Saïd Benrahma from West Ham United (€14.4m), Ernest Nuamah from RWD Molenbeek (€28.5m after having been originally signed on loan last summer), Georges Mikautadze from Metz (€18.5m), Abner from Real Betis (€8m), Mama Baldé from Troyes (€6m) and Duje Caleta-Car from Southampton (€3.59m).

Meanwhile, Lyon have seen seven departures this summer, just two of which commanded transfer fees (Jake O’Brien to Everton for €19.5m and Skelly Alvero to Werder Bremen for €4.75m), and three of whom only departed on loan.

With all of these moves in the transfer market, Lyon has been among the most active in Ligue 1 this term.

The club clearly feels the need to drastically shake things up after spending much of the season battling at the wrong end of the table in what was a campaign to forget last time around.

Lille’s €13m spent has been stretched among five new arrivals.

Their most costly piece of business saw the promising 23-year-old Norwegian playmaker Osame Sahraoui — who we scouted in a 2022 piece here at Total Football Analysis from the player’s time with Vålerenga — in from Eredivisie side Heerenveen for €8m.

The other €5m went to Belgian Pro League KV Mechelen to secure the signature of 19-year-old Ngal’ayel Mukau.

On top of that, Ethan Mbappé, Thomas Meunier and Aïssa Mandi all arrived for free.

Lille have parted ways with seven players this summer, including Leny Yoro, who joined Manchester United for €62m.

Two of Lille’s seven departures left on loan, while the remaining four made their way out of Stade Pierre-Mauroy on a free.

Right away, we can observe one clear contrast in these two teams’ respective transfer strategies: Lille’s average age of signings is one year younger than Lyon’s.

Now, one year is not a major difference, but bear in mind that Lille did not actually spend money on anyone over the age of 23 and brought in two teenagers (Mbappé and Mukau), with two 32-year-olds in Meunier and Mandi arriving on a free — they may be displaying a bit more of a desire to retain resale value in those they bring in.

On the other hand, Lyon have gone for the approach of spending on players ready to make an immediate contribution in their prime years (generally regarded as between the ages of 24-30 for a footballer).

Their biggest signing — Niakhaté — is 28 and while Nuamah in second place is 20, it must be reiterated that his signing has been in the works since last summer.

After that, Lyon have signed nobody under the age of 23, with Mikautadze the youngest.

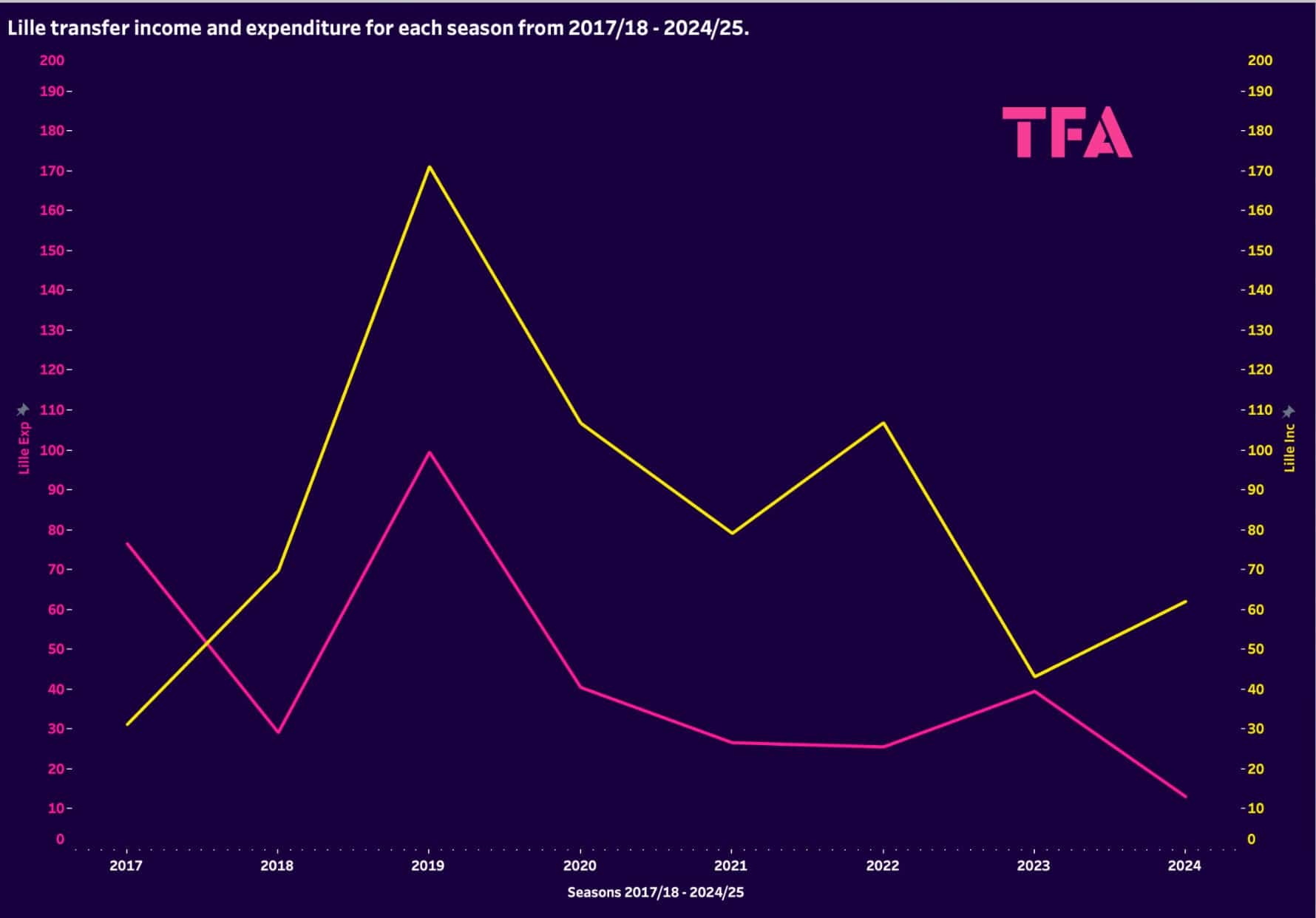

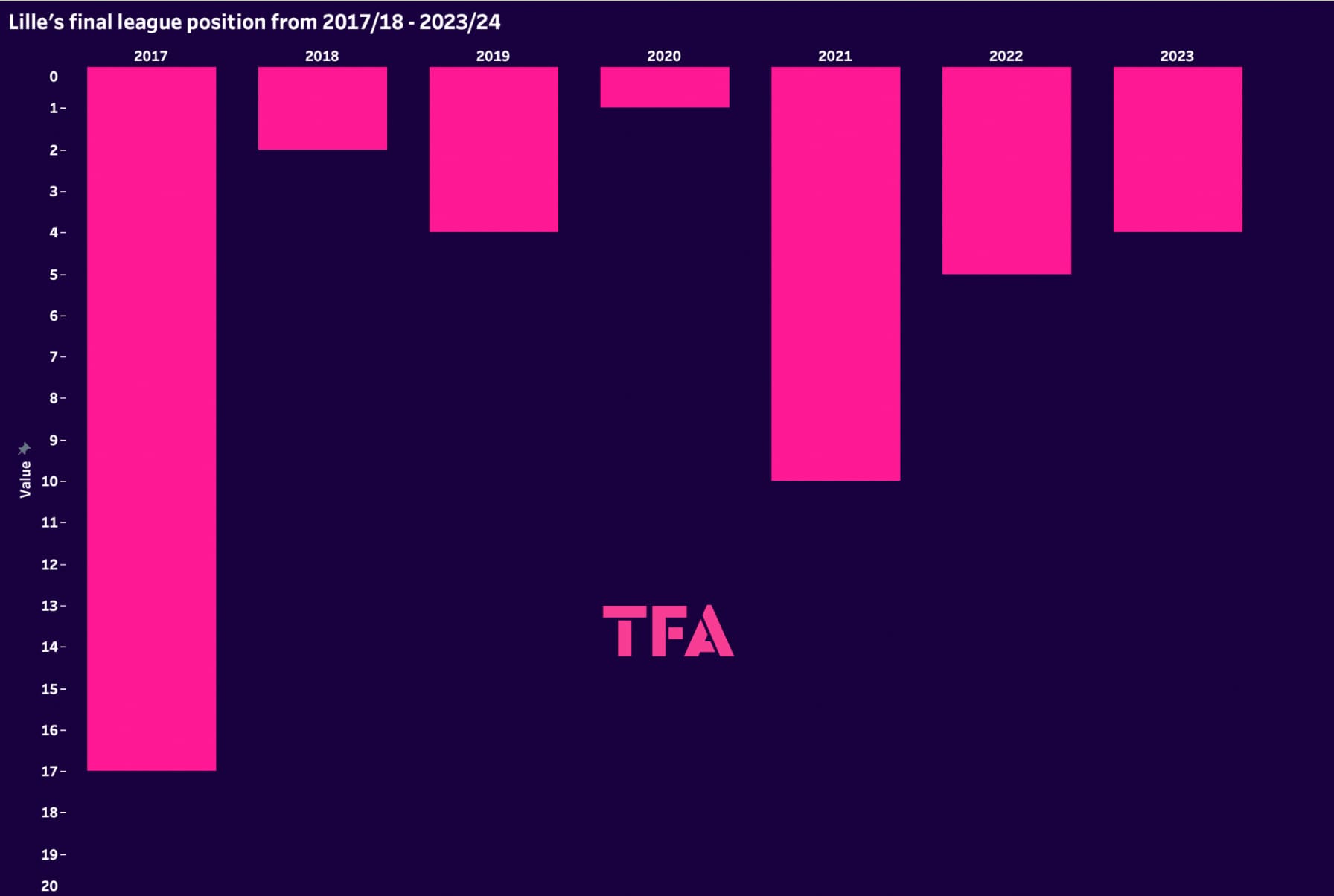

Lille’s Spending, Strategy and Success

To effectively sum up Lille’s transfer strategy, they typically prefer to invest in younger players who perhaps aren’t the finished article but who could develop into someone that can contribute significantly for LOSC on the field and eventually generate a transfer profit via their sale.

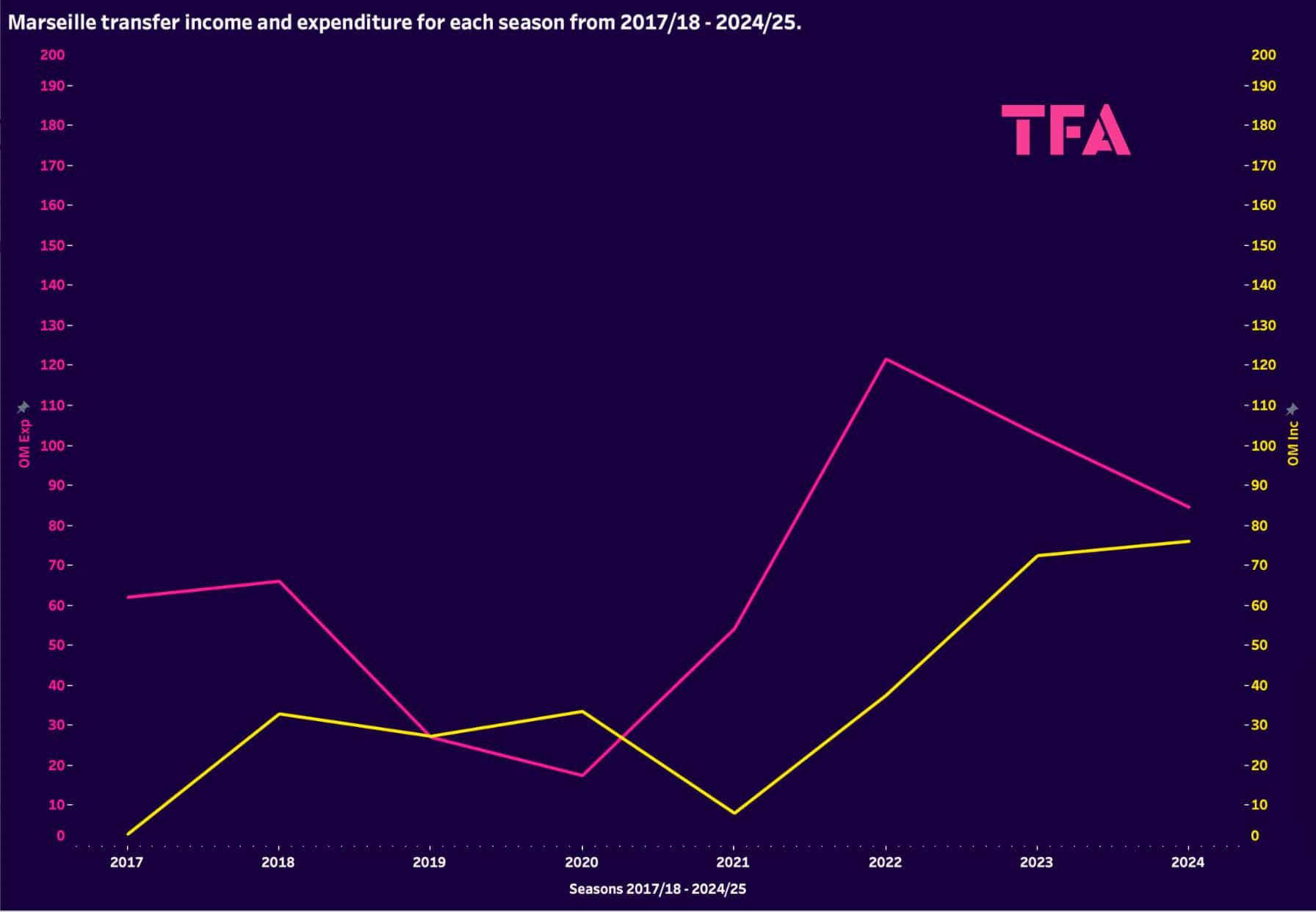

You’d have to go back to 2017/18 — Béria’s first season as Lille’s Director of Professional Football — to find the last season in which they generated a net transfer loss.

Overall, during this period shown, Lilie’s net transfer profit stands at €319.45m.

Since the last time they made a net transfer loss, their investments have been consistently repaid.

Not every player Lille sign is going to generate a profit — there will be more duds than successes.

However, they hope that, with the quality of their scouting department, the connections their recruitment team has, and their youth academy, they’ll consistently generate enough transfer profit to continue what has been a very sustainable cycle thus far during Béria’s tenure.

The transfer market model Lille champion has pros and cons.

The focus tends to be more on purchasing players before they’re the finished article and developing them within the club.

As they are open to selling their top stars — it’s part of the deal with a model like theirs — and they don’t tend to buy players of the same quality, rather players who could develop into one of the same quality as the one that just left over time — this can leave them with a squad incapable of challenging at the level they’d like at times.

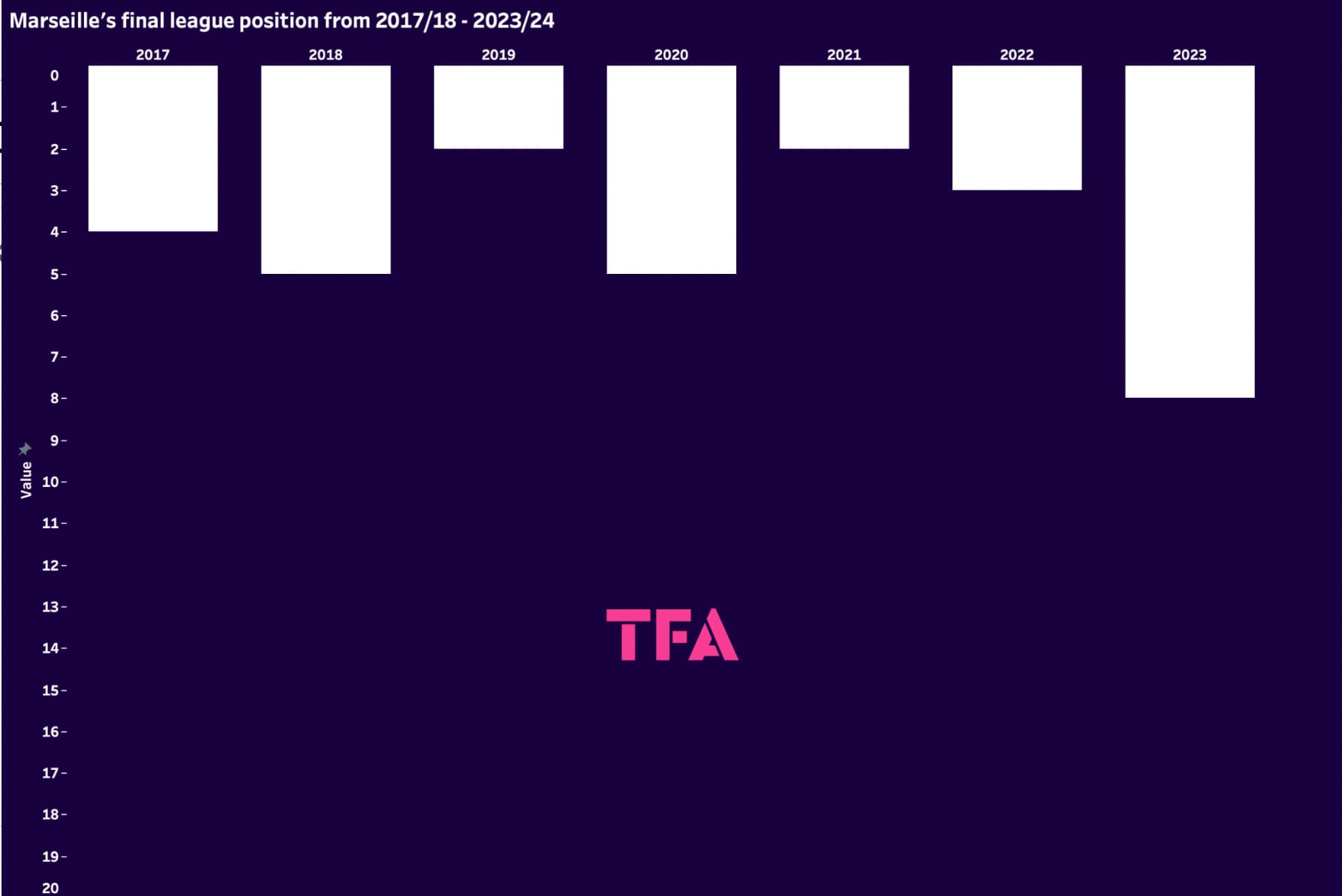

See the 2021/22 campaign above, when they finished 10th, for evidence of that.

However, there’s also a possibility that several of their investments will grow to a high level at the same time, and this can put Lille in a position to achieve something like what they did in the 2020/21 campaign when they won Ligue 1.

Crucially, since the first season after Béria’s arrival at Stade Pierre-Mauroy, Lille have never finished outside of the French top-flight’s top half, as their 10th-place finish in 2021/22 occurred when the league still had 20 teams.

In his first season as Director of Professional Football, they narrowly avoided relegation, but since then, things have been far better, with Lille typically hovering in and around the European places.

This displays that while the transfer model Lille use could have drawbacks in terms of quality on the pitch in a given season, they’ve generally been reliable.

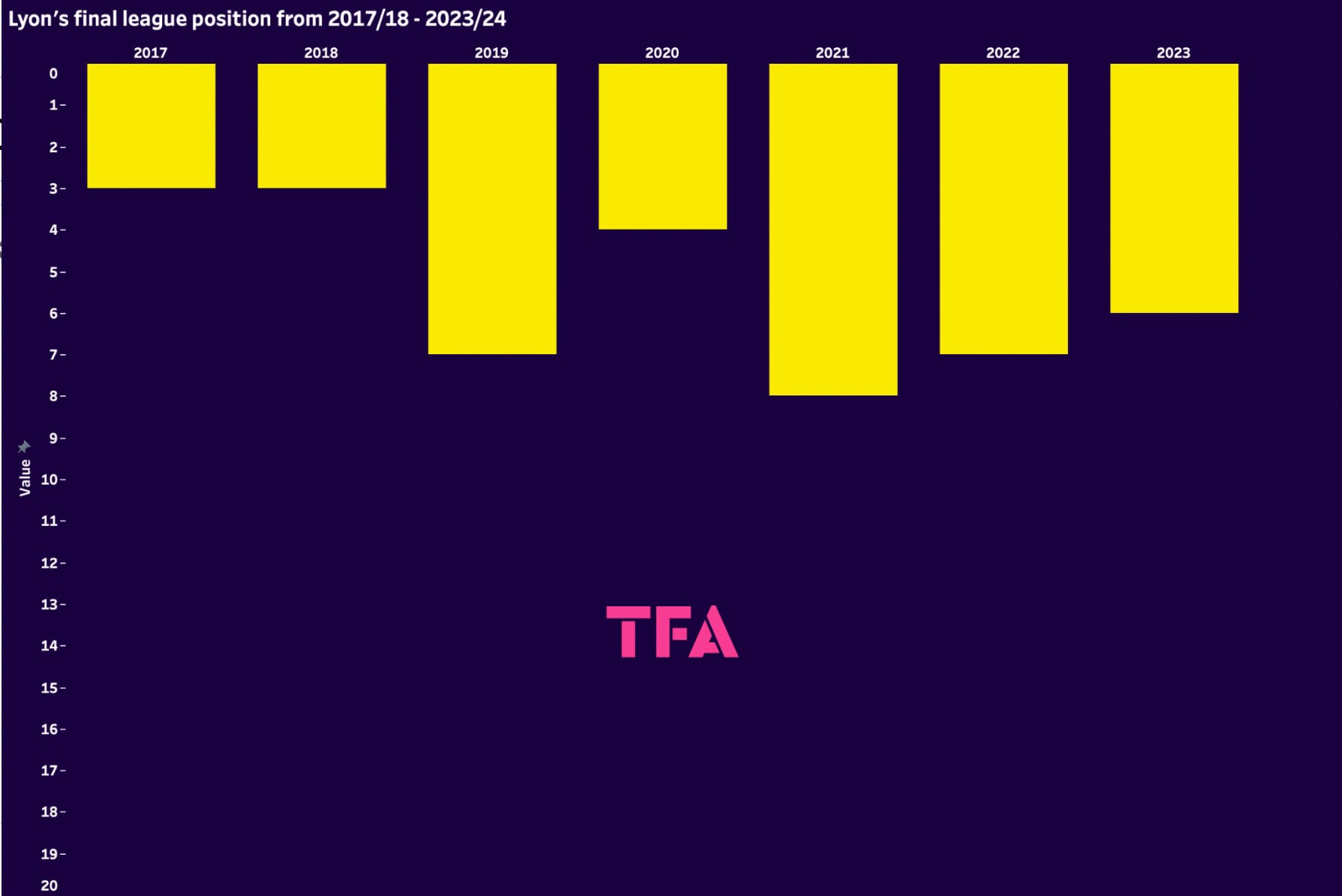

Lyon’s Spending, Strategy and Success

Meanwhile, Lyon are now just starting life with Friio as Sporting Director, so we have less insight on how successful his transfer strategy can be.

However, we can still look at the club’s approach over the same period as we focused on with Lille above, on the whole, and assess it accordingly — as well as Friio’s performance in his previous job with Marseille.

Like Lille, Lyon have mostly generated a transfer profit over time — €186.5m for the given period.

Ligue 1 is marketed as ‘The League of Talents’ and typically does play host to plenty of younger players just about to break into the ‘world class’ bracket.

Transfers are generally the main way for Ligue 1 sides to make money, so this doesn’t come as a massive surprise.

This season is a massive outlier in terms of Lyon’s transfer activity, with the club investing €110.04m in the summer transfer market to date.

During the period analysed above, Lyon have never finished below eighth in the league, but they’ve also never managed to finish higher than third.

For a club that enjoyed a significant period of dominance in the French top-flight in the 2000s and considering they were in crisis for much of last season, perhaps it’s not a surprise that this is not viewed as ‘good enough’ for them and urgent investment has come in the 2024 summer window, alongside a new Sporting Director.

Friio is no stranger to being the man entrusted with overseeing a period of significant investment.

Marseille’s chief scout from September 2020 until March 2021, he was quickly promoted during his time with Les Phocéens to become Technical Director from March 2021 until June 2022 before he became Sporting Director from July 2022 until he left for Lyon.

If we say that Friio was certainly involved in a significant capacity in Marseille’s 2021/22, 2022/23 and 2023/24 transfer windows, we can say that he was involved in the window in which they spent the most (2022/23) over the given period and was central to a three-year period in which Marseille had a net transfer spend of €160.39m — most of the €245.01m they’ve spent from 2017/18 to present.

Friio can not take sole responsibility for Les Phocéens’ lack of league success during this time, but the results on the pitch have not been what they club would’ve wanted based on the amount of money they were spending during that time.

Markets Used For Player Acquisitions: Lille vs Lyon

Our next section of analysis will take a look at comparing the different markets Lyon and Lille have used during the time frame we’ve focused on — Béria’s full tenure at Lille — to further contrast their respective transfer strategies.

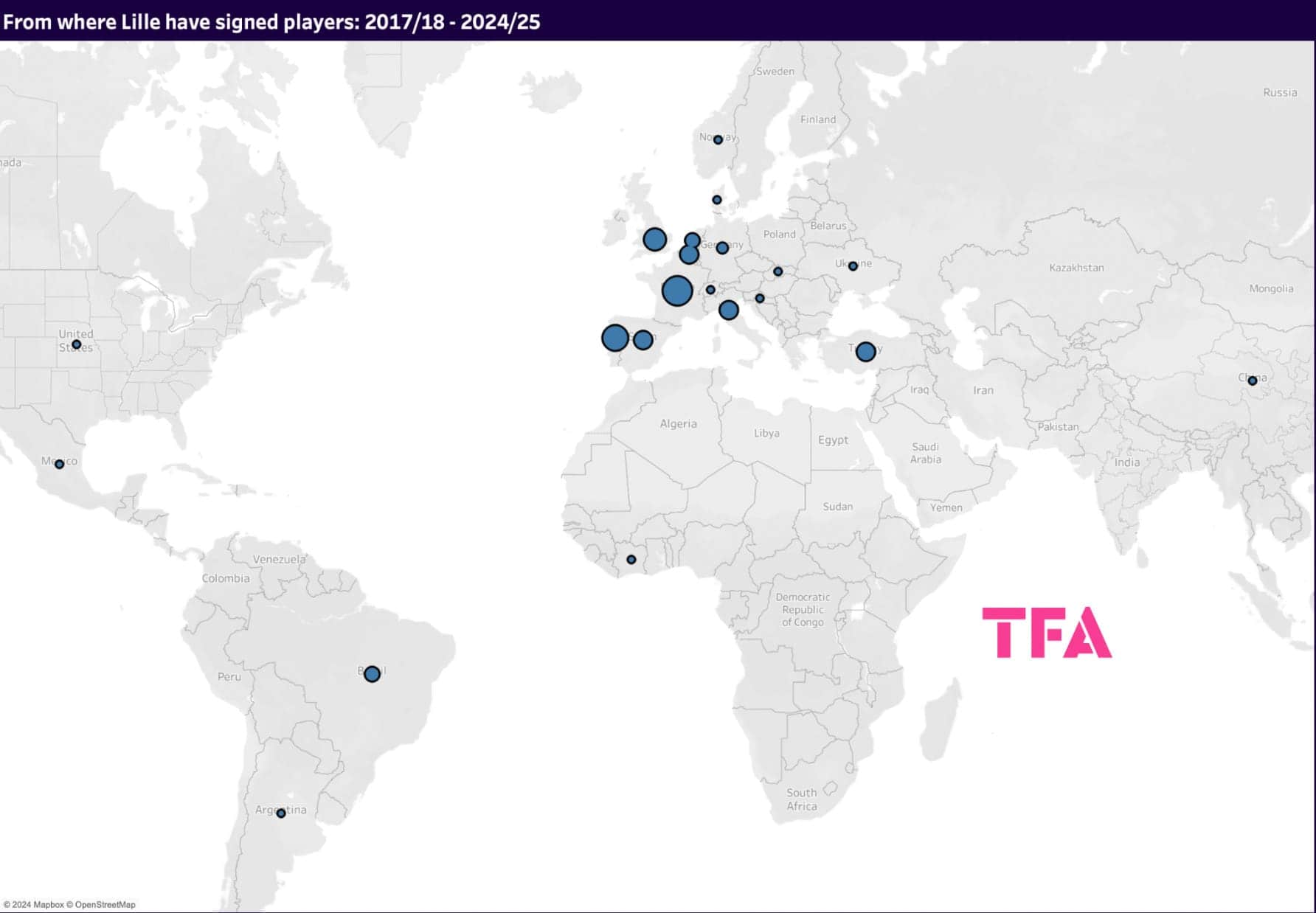

Lille have made significant use of the French market, as you might expect, with Portugal coming up second.

Les Dogues have had significant connections with the Portuguese market during this timeframe so this also does not come as a surprise but is indicative of a key aspect of their transfer strategy.

The UK, Italy, Spain and Germany have seen 15 players arrive in Lille between them — placing them on a similar level to the likes of Belgium (four), Türkiye (four), Brazil (three) and the Netherlands (three) as far as Lille signings go.

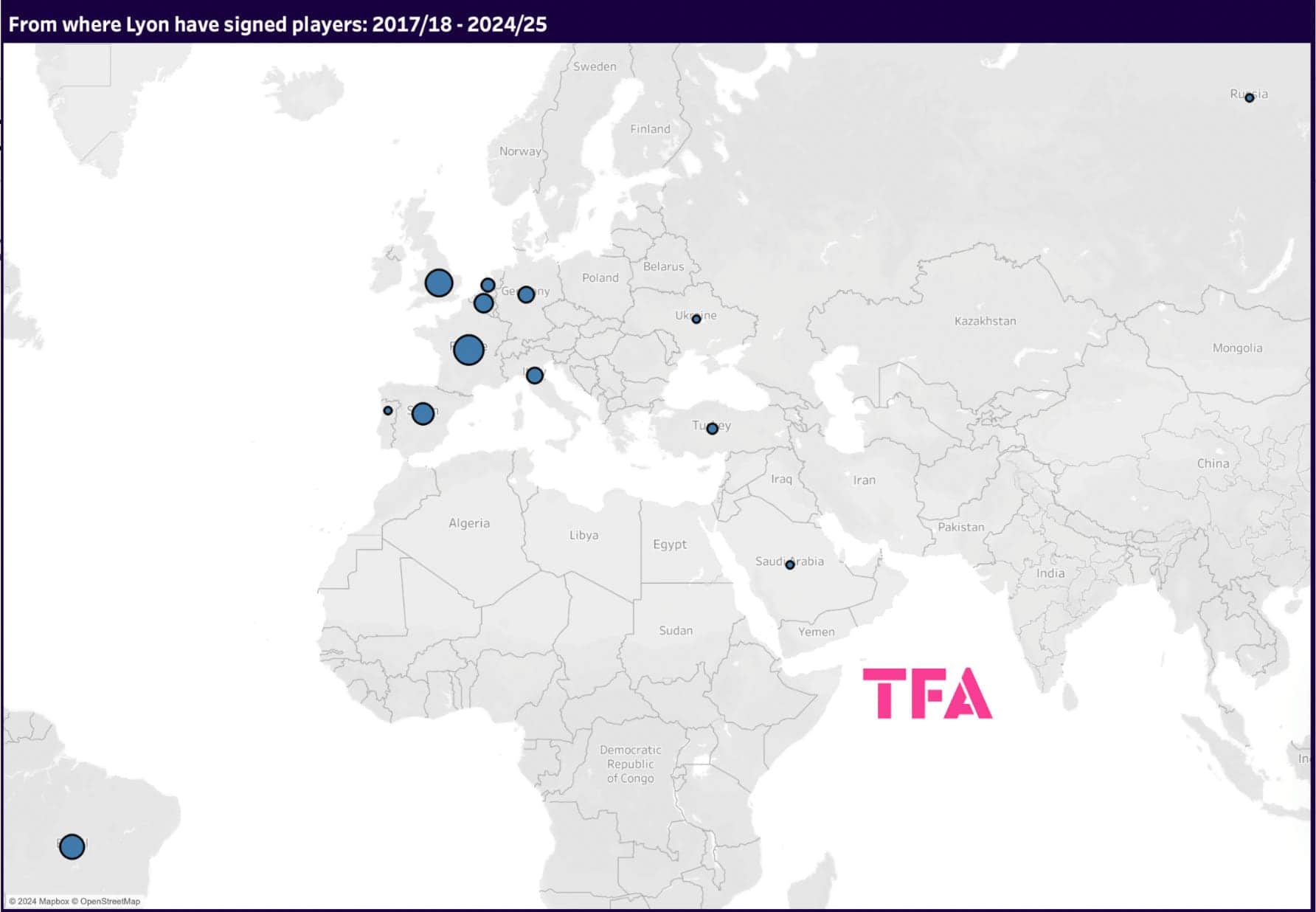

Meanwhile, Lyon have heavily favoured two markets in particular — France (24) and the UK (19) during the given period.

With significant connections in Brazil, eight players have arrived in Lyon from the South American football giants during this timeframe, with Spain (six), Belgium (five), Italy (four), Germany (four), Netherlands (three) and Türkiye (two) being the other markets from which Les Gones have made at least two signings since 2017/18.

Lyon have shopped over a slightly smaller area than Lille over this period, and they’ve made use of Europe’s top leagues a lot more, while Lille have tended to look elsewhere, characteristic of their core strategy of signing future prospects rather than the finished article.

Markets Used For Player Acquisitions: Friio at Marseille

Lastly, we’re also going to take a look at how Marseille’s transfer focus shifted as Friio became the key figure in their recruitment setup to get some insight into how he influenced their approach in this regard and what we may be able to expect from him at Lyon moving forward.

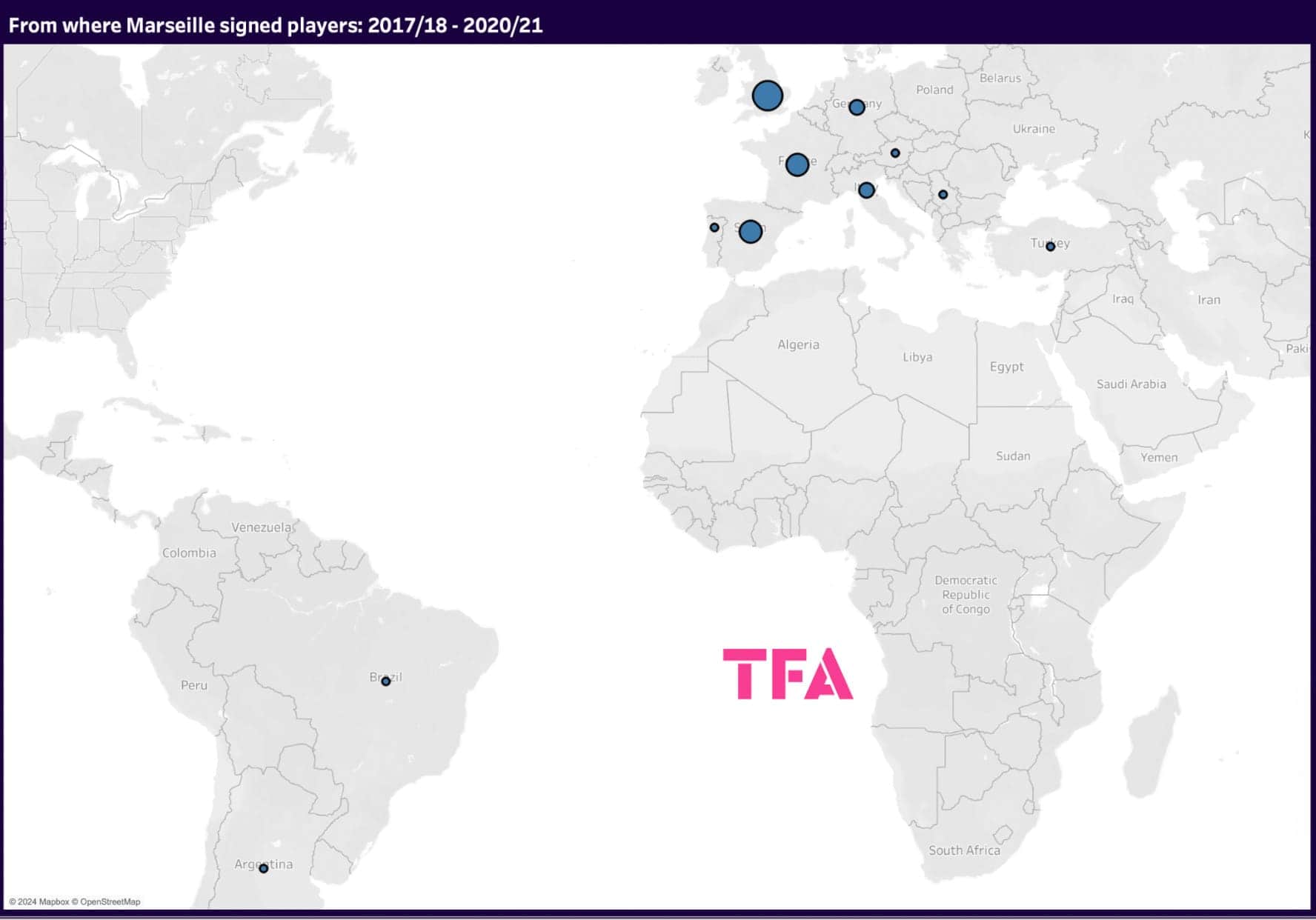

Firstly, from 2017/18 to 2020/21, Marseille only used Europe’s five strongest nations — France, England, Spain, Italy and Germany — for more than one signing, highlighting quite a narrow transfer outlook.

The UK was their most heavily-used market during this period, with six playing acquisitions, ahead of France and Spain with four apiece.

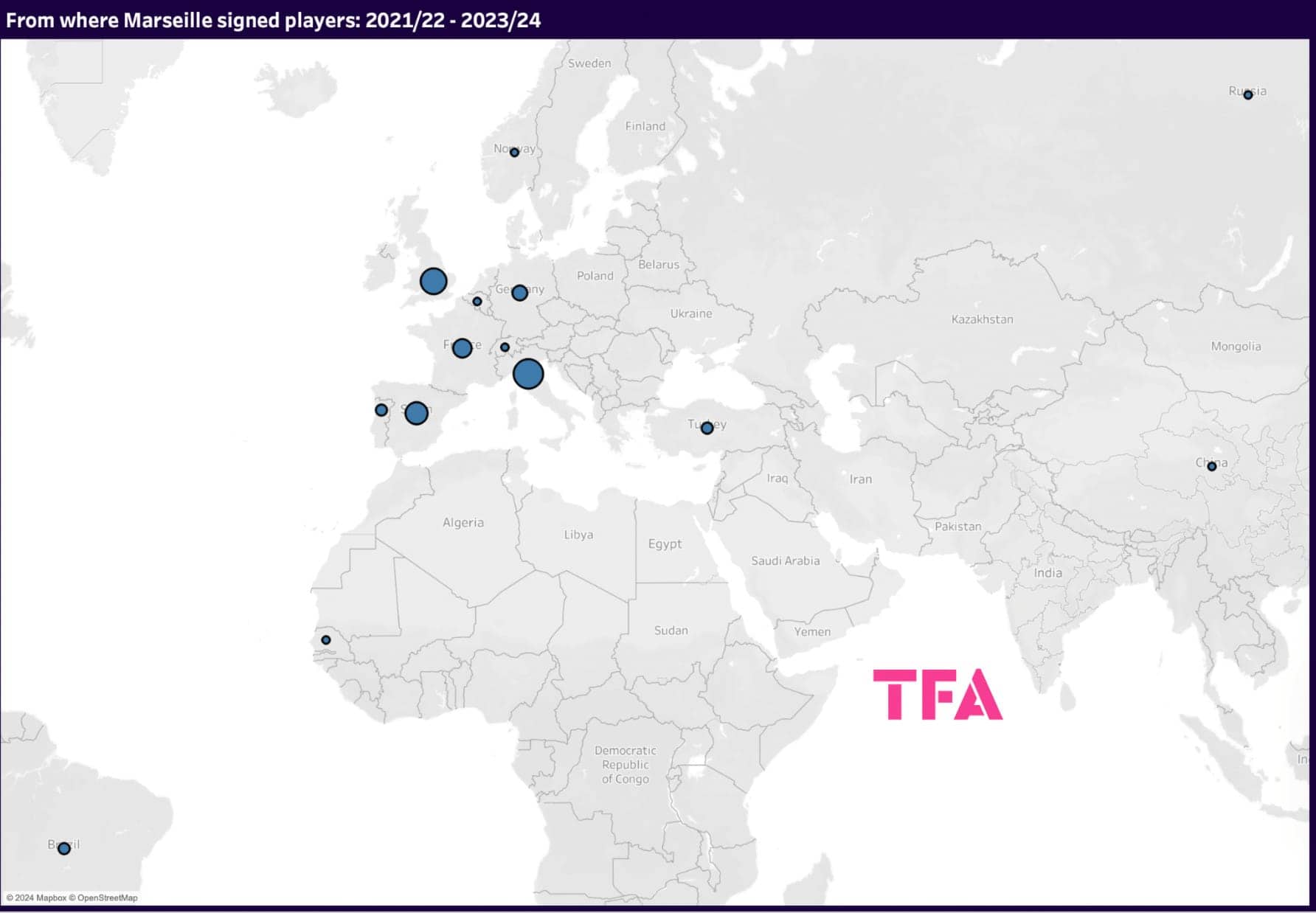

Not a tonne changed with regard to Marseille’s preference for using the more obvious targets in terms of markets during Friio’s tenure involved the club’s recruitment process.

Italy grew to become Marseille’s main market with 11 players arriving from there during this three-season period, while 10 arrived from the UK.

Spain (six), France (five) and Germany (four) followed, while Portugal (two), Brazil (two) and Türkiye (two) also saw a slight boost in popularity when it comes to Marseille’s transfer business.

Comparing this with Lyon’s transfer business this season, we can see a bit of a trend in terms of how Friio loves to conduct business in Europe’s most popular and strongest leagues.

Outside of Nuamah, whose arrival has been in the works from last season, all of Lyon’s signings this summer have come from within Europe’s top-five leagues — four coming from the EPL, two from Ligue 1 and one from LaLiga.

If you’re searching for players who will make an instant impact and get your team competing with the best of them in Ligue 1, it makes sense that the main markets used have been those with the strongest sides.

However, simply signing players from strong leagues doesn’t necessarily make the strongest squad, and there is plenty of quality talent to be found outside of those areas, as Nuamah himself has shown with Lyon and as Lille have consistently demonstrated during Béria’s time with the club.

Conclusion

To conclude this data and recruitment analysis, it’s clear that Lyon and Lille are almost embodiments of two completely contrasting recruitment styles.

One season will not be enough to fully judge someone in a position like Sporting Director or Director of Professional Football — we tend to see the results over the long term.

However, we can conclusively say that we’ve seen Béria’s tenure at Lille bring positive results with their highly sustainable recruitment policies.

In contrast, Friio’s high-spending tenure at Marseille did not yield the desired results.

Now, we have to wait and see if Lyon’s high-stakes gamble on Friio pays off where Marseille’s didn’t or if it’ll be another mark against his approach to managing the recruitment process.

Comments