Building a squad from scratch is something every football fan has dreamt of. It’s something that rarely happens in football as new clubs usually start in lower leagues where their markets are limited but it does happen in the MLS, with expansion teams starting directly at the highest level with a blank canvas they can fill as they want.

The latest club to join the MLS is Charlotte FC. The North Carolina club was awarded its spot in the league back in 2019 but the pandemic delayed its debut season until 2022, giving them over two years to prepare their squad and structure.

Charlotte are owned by David Tepper, who also owns the NFL club Carolina Panthers. The senior people in their recruitment and coaching structures are Zoran Krneta (Serbian Sports Director, former football agent), Miguel Ángel Ramírez (Spanish Head Coach, experienced in Spain, Qatar, Ecuador and Brazil) and Thomas Schaling (Dutch Head of Scouting, experienced in the Netherlands).

In this recruitment analysis, we’ll see how these people have created the squad, the ideas and tendencies behind their signings, and what the future could look like for the team.

The squad

Charlotte currently have 28 players on their roster out of the maximum 30 allowed by the rules, one of those spots being available for a senior player and one for a reserve player. The squad rules in the MLS are complex so depending on things like age, salary, precedence, etc, a player can occupy a reserve or senior spot in the squad. The league average is 27.75 players per squad so they aren’t doing anything strange regarding their squad size.

The next image shows how the Charlotte squad looks at the moment. We’ve put the players in their main and secondary positions, as per Wyscout information, so we have a clear picture of the squad depth.

At first sight, the squad looks balanced and has plenty of options in all positions. There’s just one player whose main position is a defensive midfielder or right winger but both positions can be filled by several other players so it doesn’t look like an issue. To be fair, the distinction between defensive and central midfielders is rarely clear so having four natural players for both positions plus others who can play there seems a sensible approach.

Both full-backs and the striker position are very well covered. On both full-backs, we find two players with senior experience plus a player coming from college soccer to add depth. Something similar happens upfront, with Ríos and Swiderski being experienced players and Mello a young one with some senior experience.

It’s interesting to note that the ‘10’ position, one that’s not used in all tactics, has two players that can perform well elsewhere, with Hegardt having played as a defensive/central midfielder along with as a striker, and Bender being able to play from the left. Anyway, both are very young players who are still adaptable to new positions and playing styles depending on what Miguel Ángel Ramírez wants from them.

Charlotte’s squad will probably remain like this. If they were to add something to the team, it would probably be a defensive midfielder who’s used to playing as a lone ‘6’ and with a more defensive profile, or another centre-back who can add some depth in case they use a back-three as they’ve done in some of their initial games.

Age profiling

The MLS has consistently changed over the years from a golden retirement destination to a league that develops talents and sells them for a profit. The change in the average age of players has been key to this and it’s more and more normal to see MLS clubs spend bigger figures on young players than on older and more established ones.

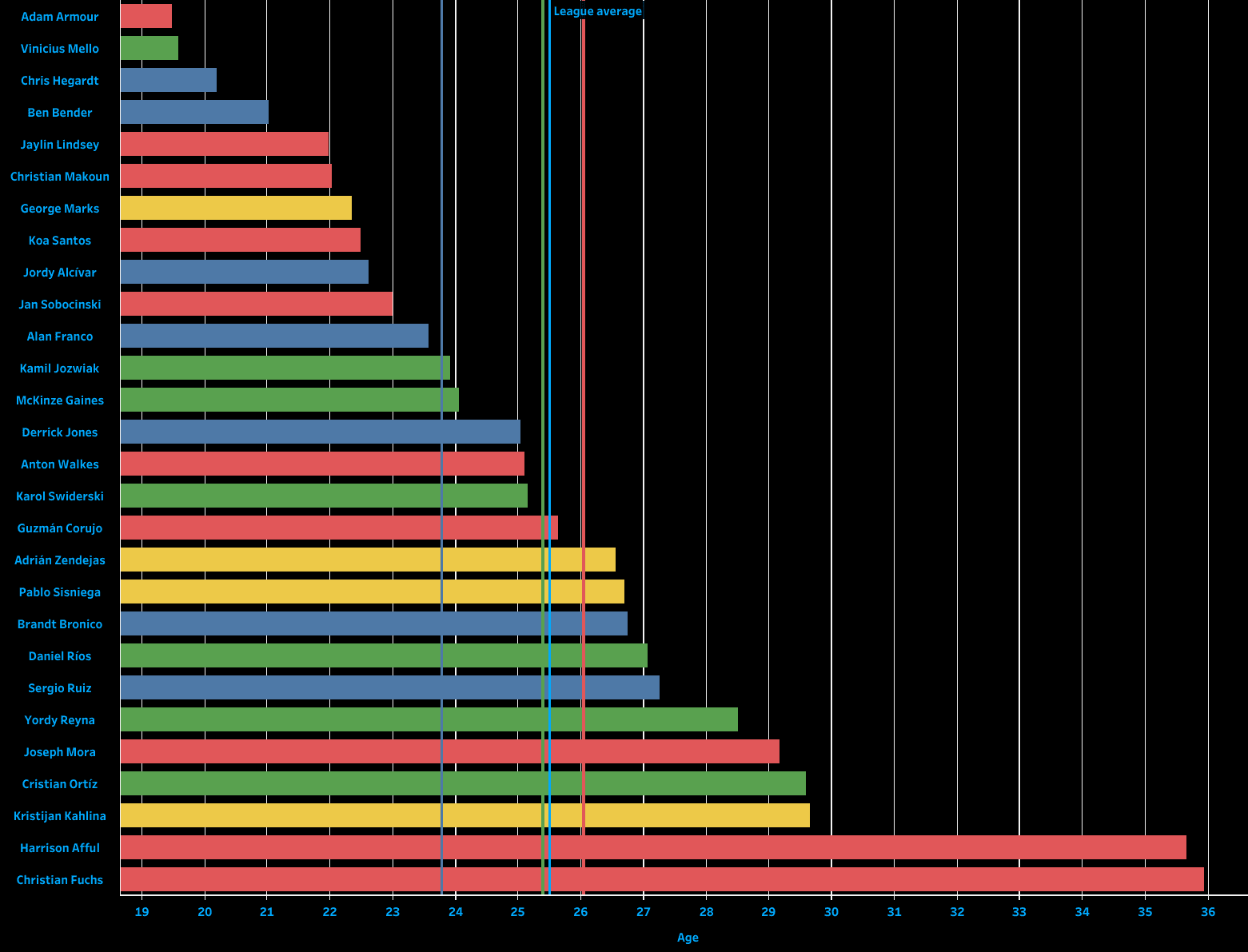

Charlotte’s squad has an average age of 25.4, which is a year younger than the league average of 26,5. The next graph shows the age of the 28 eight players, with goalkeepers represented in yellow, defenders in red, midfielders in blue and forwards in green.

Looking at the average age in each position, we see defenders have the highest (26 years). However, this is mostly because of Fuchs (35.9 years old) and Afful (35.7) being the oldest players in the squad by at least six years. Out of the 10 defenders in the team, just three are older than average and half of them are under 23, so the mix between youth and experience looks interesting.

In midfield, we find the opposite. Midfielders in Charlotte FC have an average age of 23.8. Out of the seven midfielders in the squad, just two are over the average squad age and four of them are under 24, including Hegardt (20.2) and Bender (21.03). It’s maybe here where Charlotte could look to bring an extra experienced player, most probably in the ‘6’ position we highlighted in the previous section.

Charlotte’s attack is where we find the most balance regarding age. The forwards are aged 25.4 on average, which is exactly the squad average. There are seven forwards in the squad. Out of them, three are over 27, three between 23 and 27 and one under 23 (Vinicius Mello, 19.6). With most players in their peak age, Charlotte didn’t want to gamble too much in attack.

Finally, it’s interesting to see the age of both designated players. Karol Świderski is a striker aged 25.15 (born in 1997), while Kamil Jóźwiak is a winger aged 23.9 (born in 1998). While teams usually use their designated-player spots for older players who are more experienced at the highest level, Charlotte have gone for two players entering their peak years, which again shows the tendency to sign younger players with resale value as we mentioned earlier.

Nationality and language

In this section of the recruitment analysis, we’ll see the markets Charlotte FC have targeted to find their players. We’re going to look at the leagues and countries they come from, their nationality and the language they speak. We should remember that, on average, MLS teams can have up to eight international players. These international spots are tradable so there will be teams with more and less than eight.

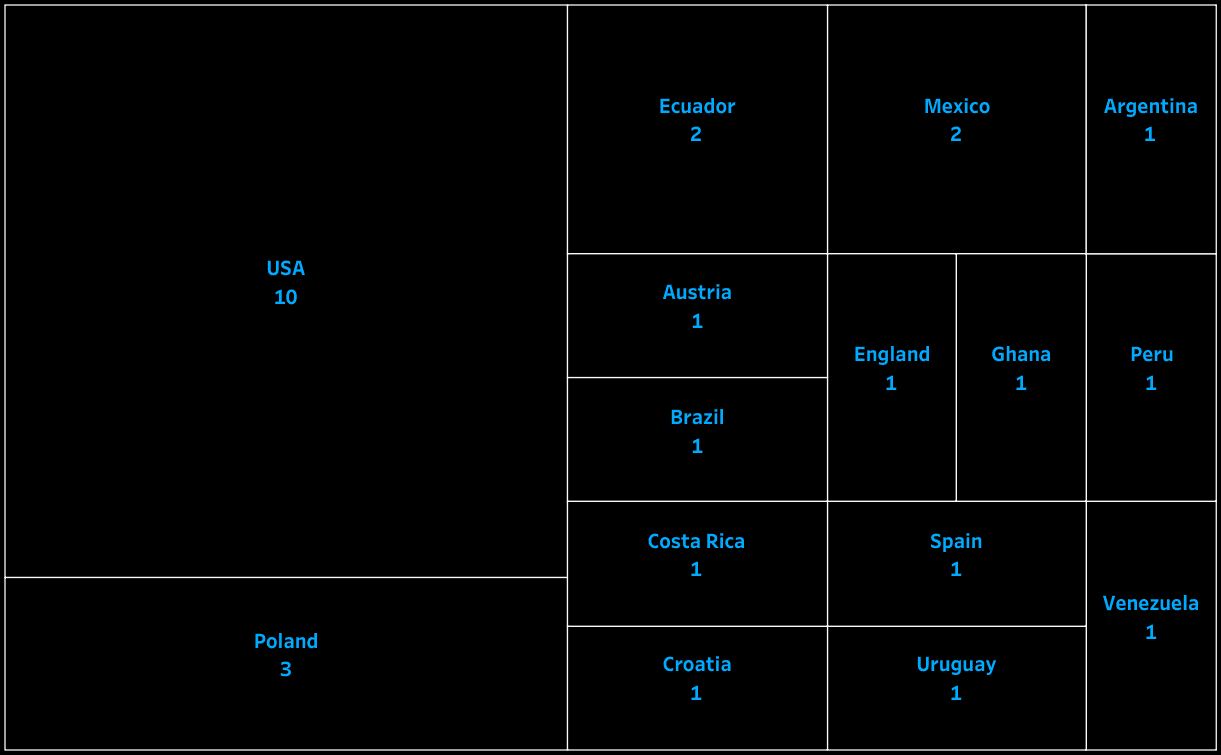

Charlotte have assembled a very multicultural squad. 64.3% of their players are foreigners, which is higher than the league average of 55.5%. In their 28-man squad, Charlotte have players from 15 nationalities and just four of those nationalities have more than one representative.

In the next chart, we see a summary of the nationalities in the squad.

As expected, the most-represented nationality is American with 10 players. Interestingly, there are three Polish players in the squad as none of the possible decision-makers has a clear connection to Poland. It could be either a coincidence or a country the club has identified as a potentially interesting market.

The signing of two Ecuadorians is easily explained by Ramírez’s experience in the country. He coached Alan Franco at Independiente del Valle and probably knew Jordy Alcívar from his time there too.

What’s especially interesting looking at the players’ nationalities is that 12 of them (43% of the squad) speak Spanish, with Sisniega and Zendejas holding a Mexican passport apart from their American one. Communication is a key aspect in recruitment that often gets overlooked and signing some players that can communicate in their native language with the coach and teammates can help a lot in the adaptation and performances.

Target markets

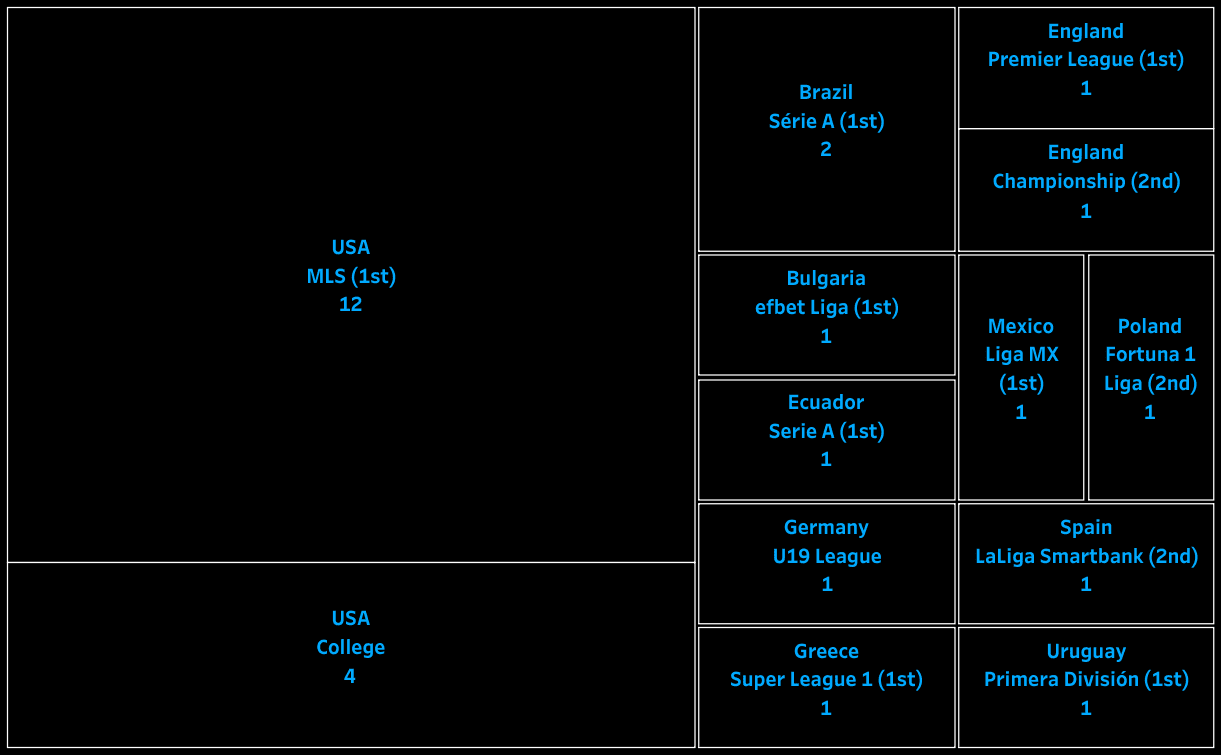

Here, we’ll see which leagues and countries Charlotte have targeted to recruit their first-ever squad.

As it’s logical, most of their squad comes from American leagues. Half of the 28 players Charlotte currently have in their squad were playing in the USA before signing for the club — 12 in the MLS and four in college soccer. Three of the players coming from the MLS were chosen in the Expansion Draft in which Charlotte had the right to pick players from other teams under certain restrictions.

There are only two countries from where Charlotte have signed more than a player: Brazil and England. From Brazil, they brought Alan Franco (loan from Atlético Mineiro) and Vinicius Mello (bought from Internacional), both players having been coached by Ramírez. From England, they brought two of their designated players: Christian Fuchs from Leicester City (EPL) as a free agent and Kamil Jozwiak from Derby County (EFL Championship) for €2.36 million.

Looking at the broader picture, Charlotte have targeted some of the European second-level leagues like the Spanish second division or the Greek Super League and even lower like the Bulgarian league and the Polish second division. They’ve also taken five players from South America and Mexico, which are some of the traditionally popular markets among MLS clubs.

An interesting detail is what Charlotte did with the players they signed very early when the team wasn’t playing yet. Three of them (Adam Armour, Brandt Bronico and Christian Fuchs) spent some time on loan at Charlotte Independence in the USL Championship, which surely helped them adapt to the city.

Jan Sobocinski was loaned back to LKS Lodz after paying the club €1.8 million for him, while Sergio Ruiz was loaned to the same league he came from, the Spanish second division, but to a different club (Las Palmas) as Racing de Santander, his previous club, were relegated to Primera RFEF.

Fees and types of signing

To form their current squad, Charlotte spent €17.04 million but they also collected €4.43 million in some interesting deals they made between their inception and their first season. With MLS teams being able to trade other things apart from money for players (Draft picks, budget money, different player spots, etc), the fee of a transfer doesn’t always have all the information about the deal.

Let’s start with the players Charlotte signed but who aren’t part of the squad. One of them is Kyle Holcomb, who was selected as the 29-overall pick in the 2022 MLS SuperDraft but didn’t sign for the club in the end.

More interesting are the cases of Ismael Tajouri-Shradi and Tristan Blackmon. Charlotte selected both players in the Expansion Draft but sold them to Los Angeles FC and Vancouver respectively, raising around €800,000 for both.

The best deal Charlotte made was Riley McGree. They signed the Australian midfielder for €536,000 in 2020 and loaned him to Birmingham in the Championship. His performances while on loan were so good that Middlesbrough bought him for €3.64 million, which is almost 7x the fee they originally paid.

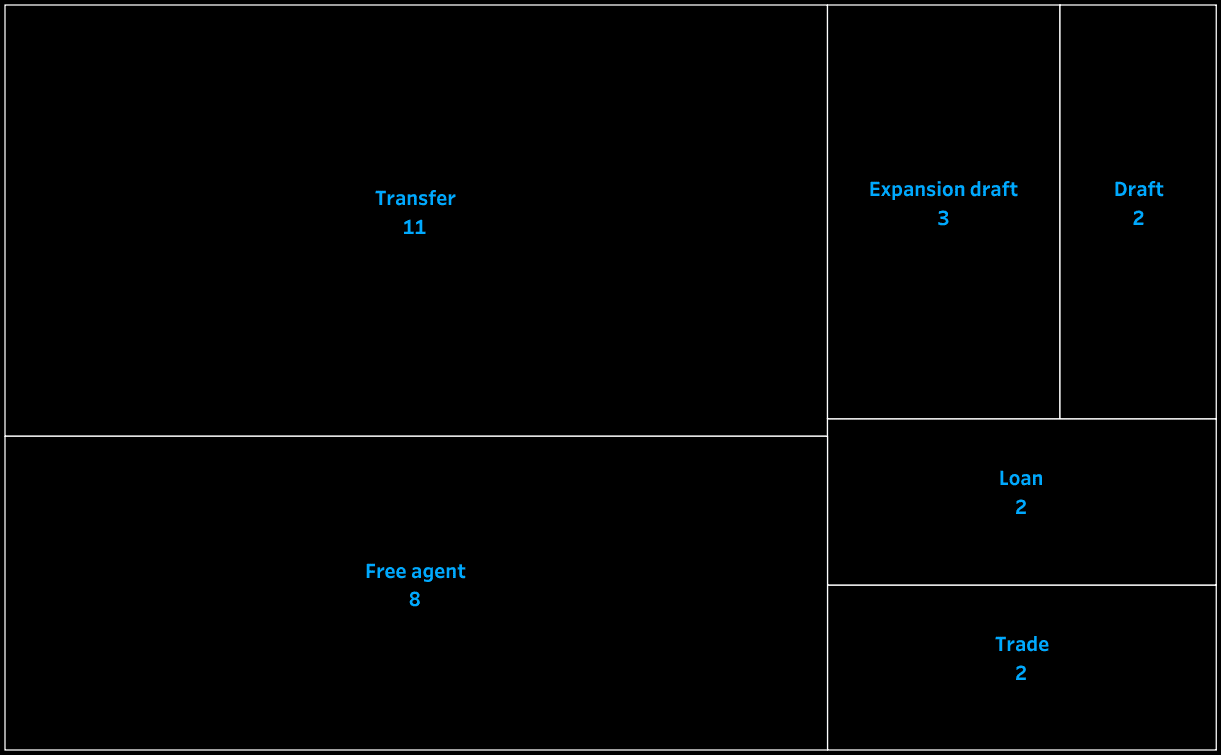

Let’s look, now, at the players who are still in the squad for the 2022 MLS season. The next chart shows the type of transfer for the 28 signings Charlotte made.

Charlotte paid some kind of transfer fee for 11 of their players, which is 39% of the squad. We’ll have a closer look at this later on.

Eight players arrived at the club as free agents, showing Charlotte’s ability and impressive planning to pick interesting players whose contracts had expired. Charlotte were announced as a new MLS team in December 2019 so they had over two years to prepare for their first-ever season, and this can be seen in how they took advantage of the free-agent market.

Five signings were made through different drafts. Three out of the five players they chose in the Expansion Draft (Mora, Walkes and McKinze Gaines) are still at the club, and they have also kept Marks and Bender who were chosen in the SuperDraft.

Two players were traded (Bronico and Makoun) for other things apart from money and two arrived on loan (Franco with a loan fee of €135,000 and Cristian Ortíz without a loan fee).

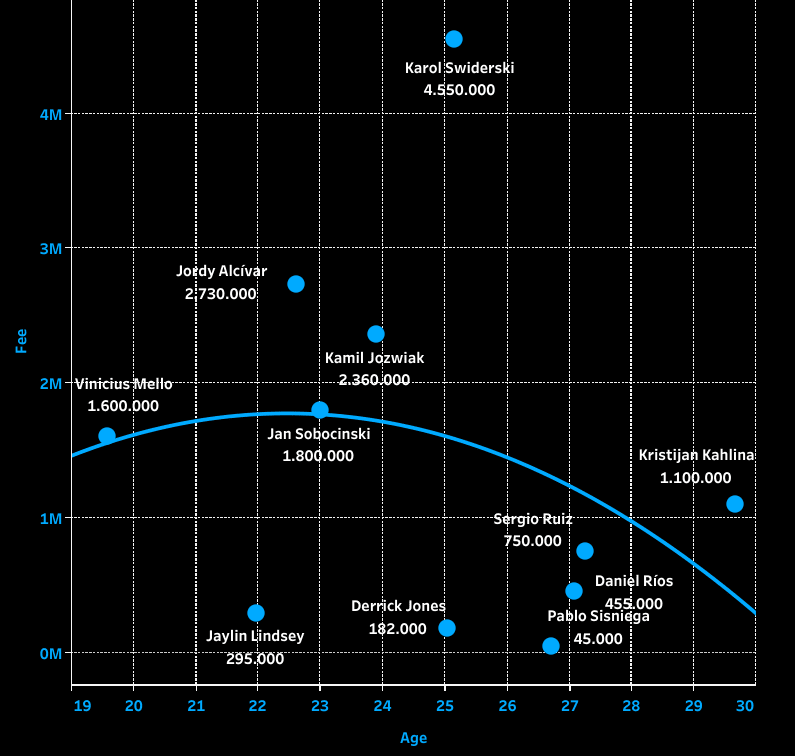

Let’s analyse the players Charlotte bought in-depth. The next picture shows the 11 players Charlotte signed with their ages and the fees they paid. The blue line shows the trend of the transfer fees related to the age of the player.

Before getting into any individual analysis, it’s interesting to look at the whole picture. Charlotte have spent the most on players aged between 22 and 25 who are entering their peak years but still have a future sale value. The highest fees were spent on the three designated players (Alcívar, Swiderski and Jozwiak), which is again consistent with the idea of these players being the ones who should carry the team and have a higher value.

For players aged 26 or older, Charlotte haven’t paid too much with the exception being Kahlina, who despite being 29 cost €1.1 million, which is still understandable given he’s a goalkeeper and has more peak years ahead of him.

Their youngest buy, Vinicius Mello, cost €1.6 million, more than any of the older players, which also shows the club’s ambition and tendency to spend (invest?) money on young players who can develop and be sold for a healthy profit.

Charlotte have built their squad with a net spend of €12.6 million, which looks like very good business when compared to other clubs. To add some context, there are five MLS teams with a higher net spend than Charlotte since 2020: the previous two expansion teams who also had to get whole new squads (Cincinnati and Austin), Atlanta United, Chicago Fire and NYCFC.

Conclusion

Despite their bad start in the MLS, Charlotte seem to have built an interesting squad. They haven’t spent crazy money to put the team together and their spending has been mostly on players they can profit from in some way, showing it’s not only a squad for the 2022 season but also the future of the club.

They seem to have taken their scouting very seriously as they have taken players from lots of very different places instead of focusing on a couple of easy markets where they may have contacts or previous knowledge. If the squad turns out to perform well and they achieve their goals, they will have shown that MLS clubs can recruit from almost all over the world and don’t have to just look at the traditional markets to succeed.

Comments