It is not an exaggeration to say that Shakhtar Donetsk have successfully gamed football’s multi-billion transfer market: buying low, selling high, while maintaining a team of 11 players capable of competing against Europe’s elite. A decisive role in this development was played by the Brazilian connection of Donetsk. Funded by billionaire Rinat Akhmetov, who bought the club in 1995, the club was able to pay significant transfer fees every season including high salaries.

I’ve always been fascinated by this development and Shakhtar’s strategy. How could a Ukrainian small-market club attract so many of Brazilian’s standout young prospects and make a business model out of that strategy? Why is their success rate so high? Before we find it out in this recruitment analysis, here are three figures that give a first indication:

- Average fee: €7.86 million

- Average age: 19.87

- Average senior minutes before transfer: 3,173

The start of the Ukrainian-Brazilian combination

Until the appointment of Mircea Lucescu in May 2004, Shakhtar were just a “normal” Ukrainian club. However, with the ambitious Lucescu, things changed. The new head coach had a clear plan of how he wanted to build his new team and started the Brazilian revolution in January 2005 by signing the midfielders Jádson and Elano.

The idea behind it was relatively straightforward: While the defence consisted of the best Ukrainian players, Lucescu wanted to build an attack with young and hungry Brazilian players who wanted to prove themselves in Europe. This strategy was extended in the following transfer periods with more and more Brazilians arriving in Eastern Ukraine.

The key to Shakhtar’s strategy to succeed is their ability to identify talents in the market, develop them, benefit from their performances, and eventually sell them on for profit. Shakhtar complemented their superior knowledge of their domestic market with the recruitment of standout young Brazilians to form a Ukrainian-Brazilian combination. What makes them so attractive is the fact that they can offer extensive playing opportunities, which allows them to compete for talents against other clubs with greater financial power. They have built a reputation for being a perfect first step in Europe before moving to an absolute top club.

Shakhtar and the love for Brazil’s U20 national team

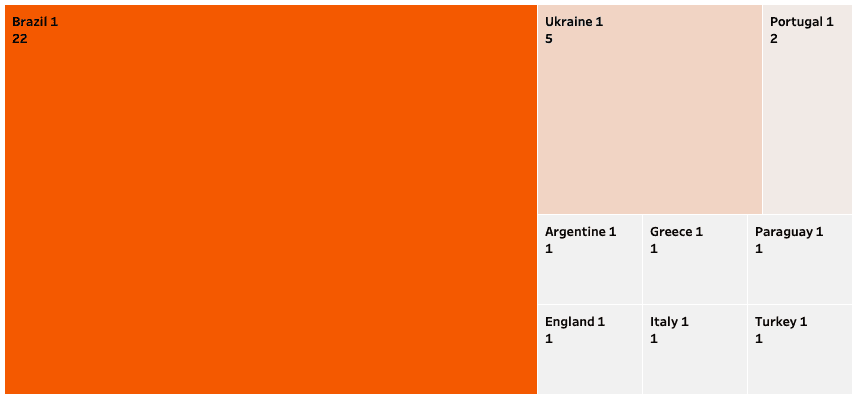

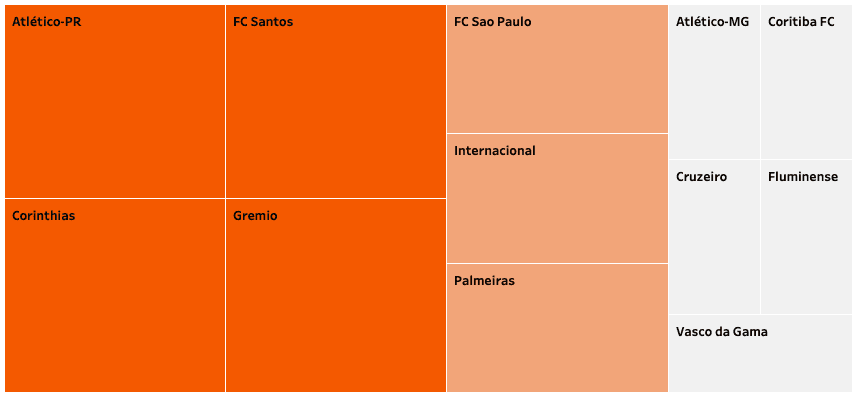

When I did the analysis of Shakhtar’s transfers since 2004/2005, I started from a broader perspective first and looked at all South Americans that were signed regardless of the league they played in. Overall, from 35 South Americans, 32 were Brazilians from the following leagues.

Therefore, I decided to focus on players from the Brazilian league in this analysis. I also included Marcos Antonio, who was transferred to Estoril in Portugal, made six appearances before he was moved on to Donetsk six months later. Shakhtar do not show a particular preference for certain Brazilian clubs but sign from a variety of clubs.

According to FiveThirtyEight’s Global Soccer Index, the quality of Brazilian teams is worse compared to Europe’s elite. There are only three Brazilian clubs among the top 100, while there are all but two Premier League clubs for instance. Donetsk offer an opportunity as an intermediate step where they can get used to the new level and gain extensive playing time in a relatively weak league but also play in the UEFA Champions League.

If we look deeper into the career paths of Shakhtar’s recruitments, it becomes evident that most of them might have appeared on the radar due to their performances for the youth national team. For Shakhtar, the Brazilian U20 national team has become the hotspot for their recruitment of standout talents.

Out of 23 players, 17 have played in the Brazilian U20 national team before they signed with Shakhtar. It’s particularly striking if we look at the recent U20 South American Championship in 2019. While Shakhtar had already signed Marquinhos Cipriano in the summer before the tournament, they signed Tete, Marcos Antonio, and Vitao in the two following transfer periods.

What’s the value of experience?

One could define Shakhtar’s strategy a bit like a venture capital approach. Due to their competencies in the Brazilian, they can acquire worthy assets (players with high potential) that they might turn into significant profits one day. Nevertheless, they are aware of the degree of randomness and unpredictability, which is inevitably involved in young player development.

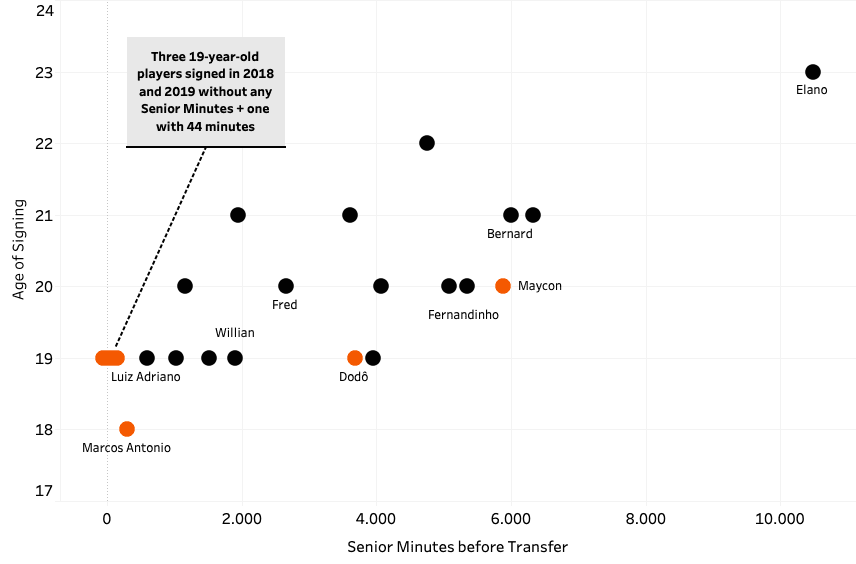

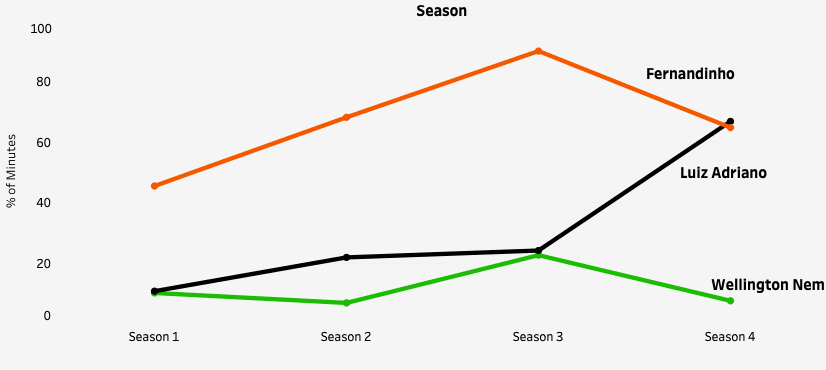

Even though Shakhtar sign their players at an average age of 19.87 years, most of them used to have already played on the top level in Brazil. Until the summer of 2013, they mostly bought players that had accrued one, two, or even three seasons on a senior level. The average Brazilian had 3,764 minutes of experience with Elano (10,477 minutes) and Luiz Adriano (600) being the outliers.

What makes the graph above so interesting is the change in Shakhtar’s strategy, which started to become even riskier in 2018. It is illustrated by the orange markings. After Shakhtar didn’t sign players from Brazil for more than four years due to the war (which we will come back to later), they started to buy players without any experience on a professional level. In fact, three of seven players that were signed since then had accrued no minutes before they were transferred to Eastern Ukraine. Besides, Fernando only had 44 minutes.

What are the reasons for this development? First, the market has changed, as has Shakhtar Donetsk’s financial situation. They’re not able to spend extensive amounts of money but allocate it conscientiously. If a player gets significant minutes in Brazil’s first league, he would probably be already too expensive nowadays. Besides, the war for talent has become even more competitive with clubs being ready to take risks and spend big. Back then, for example, it would have been unimaginable for Real Madrid to buy two 18-year-old Brazilians (Rodrygo and Vinicius) for €45 million each.

Another interesting aspect is the signing of the Portuguese Jose Boto as the new scouting department director. Before joining in Shakhtar in July 2018, the 54-year-old headed the scouting unit of Benfica Lissabon for more than ten years. Since his arrival, he has already bought six Brazilian talents. His job profile is probably quite similar to what it was for Benfica: Spot young, highly talented players that can be developed and eventually sold on for a profit.

How long does the acclimatisation period take?

The progress of a player and his adaption to a new environment is a multilayered topic. You don’t have to be a prophet to guess that it is not necessarily easy for a 19 or 20-year-old to move from Brazil to Ukraine. Therefore, it has always been important for Donetsk to create a familiar environment, in which the Brazilians can feel comfortable. The fact that they could build a community of Brazilians and that Lucescu, as well as his successors, are fluent in Portuguese helps a lot in this regard.

However, this doesn’t mean that they don’t need time to adapt. In fact, only two (!) players played more than 50% of all minutes in their first season in the league. To put it differently: The chance that a new Brazilian talent becomes a core player in his first season in Eastern Ukraine is 9.5%. Given the circumstances and their age, this is not necessarily surprising but still something I did not expect. Not even the most expensive players Bernard (who was already a Brazilian international), Fred, or Tetê exceeded that threshold. To underline that even more: 14/21 players saw less than 30% of all minutes in their first season. Their signings are by no means an overnight success but need time to acclimatise and develop.

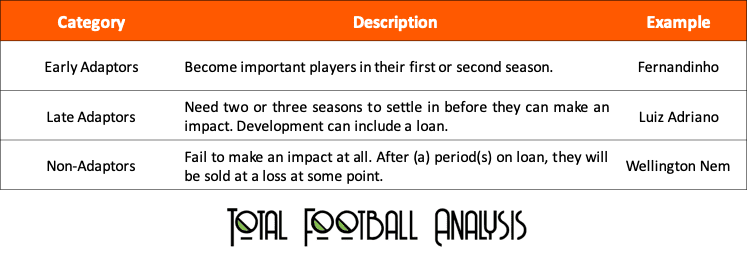

Essentially, we can classify the adoption of Shakhtar’s signings into three categories based on the five segments of technology adoption:

Obviously, this classification is not perfect and can be done in many different ways. There are numerous reasons from injuries to bad shape how a player settles in and develops. However, it can give an overview of how players adapt to their new environment and reassure that some players just need more time than others. With that in mind, Shakhtar can plan ahead and buy players now, knowing that they might just show their full potential in two or three years. Typical paths in terms of playing time are shown below.

A special and interesting case is Alan Patrick. The 29-year-old midfielder did hardly get any playing time during his first six seasons and was loaned out back to Brazil four times. However, in his seventh season, he finally became a regular starter and one of the most important players at Donetsk. Loans are generally a popular possibility that Shakhtar use if they realize that players need more time to develop elsewhere. Right-back Dodo is another good example of that.

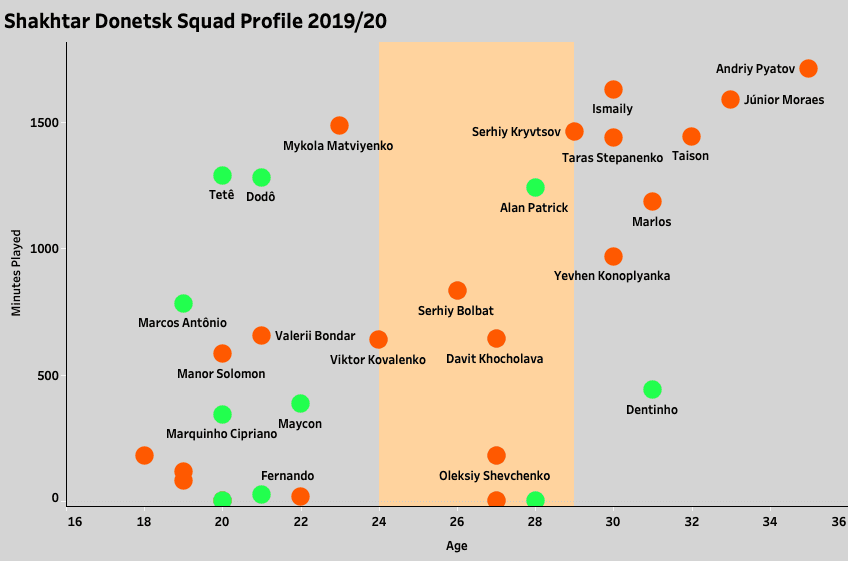

Overall, one can say that Shakhtar don’t have a short-term oriented time horizon by signing players but know that players might need a few seasons to settle in and show their full potential. What’s striking is the fact that, even though it’s only an intermediate step to a top European club, players stay for almost five years at the club on average. They usually leave in their mid-20s, entering their peak.

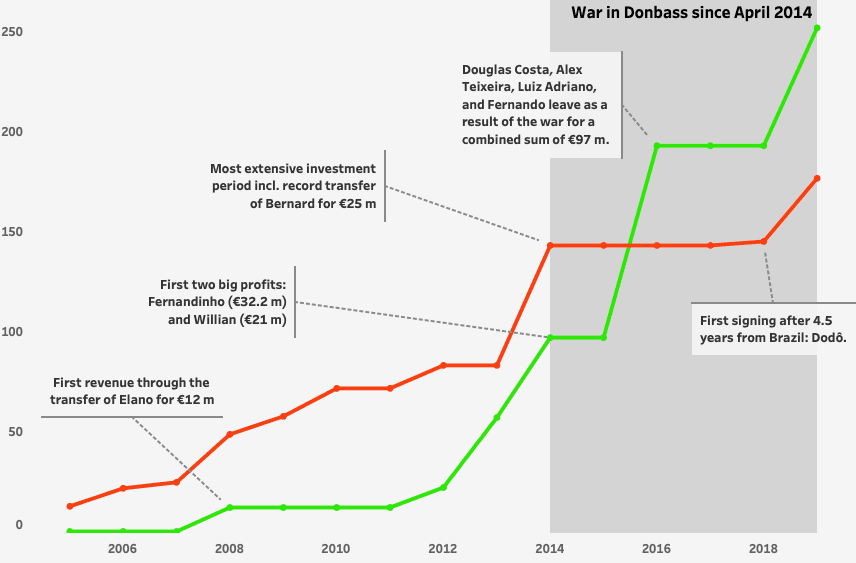

Return on Invest

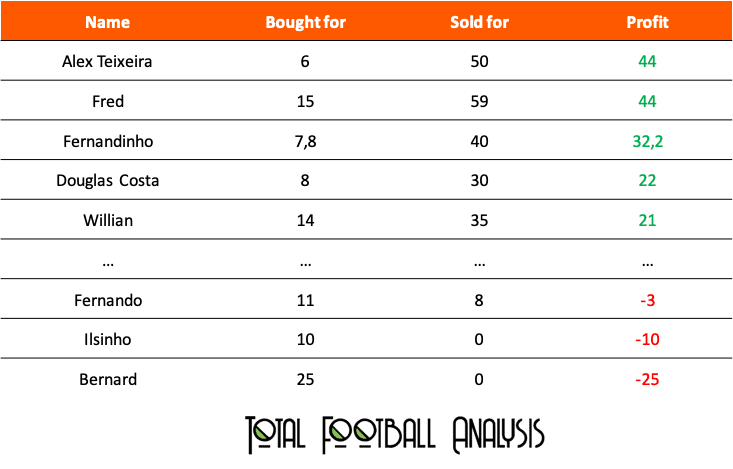

I indicated it in the introduction: Shakhtar have successfully gamed the transfer market, and player trading is a big part of their business model. It helps them to grow their revenues beyond what can be expected from sponsorships, broadcasting, and, more generally, the economy that they are based in. This is reflected in statistics about their profits with Brazilian talents. There are a couple of players, who stand out, which all of us know very well.

With these five players alone, Shakhtar generated revenues of €214 Mio and a profit of €163.2 Mio.This corresponds almost to the total investment of around €180 Mio in 23 players from the Brazilian league. Ten of them are currently still playing at the club with a total market value of €43.1 Mio and might, therefore, generate further revenues in the future.

Based on our previous classification, we’ve seen that Shakhtar inevitably makes some transfers that do not bring the expected success. That said, the losses are easily compensated by the big profits they made with other players. In fact, the biggest losses came from players running out of contract, who have made an impact while they were at the club.

Part of Shakhtar’s strategy is also paying transfer fees over the market rates for players. Transfermarkt only had a market value for 15 of their 23 recruitments from the Brazilian league. Based on these transfers they overpaid them by 83%. However, it is important to stress that they have been right to do so in many cases as players made up for this overpayment quickly. For example, Fernandinho only had a market value of €0.5 Mio when Shakhtar bought him for €7.8 Mio.

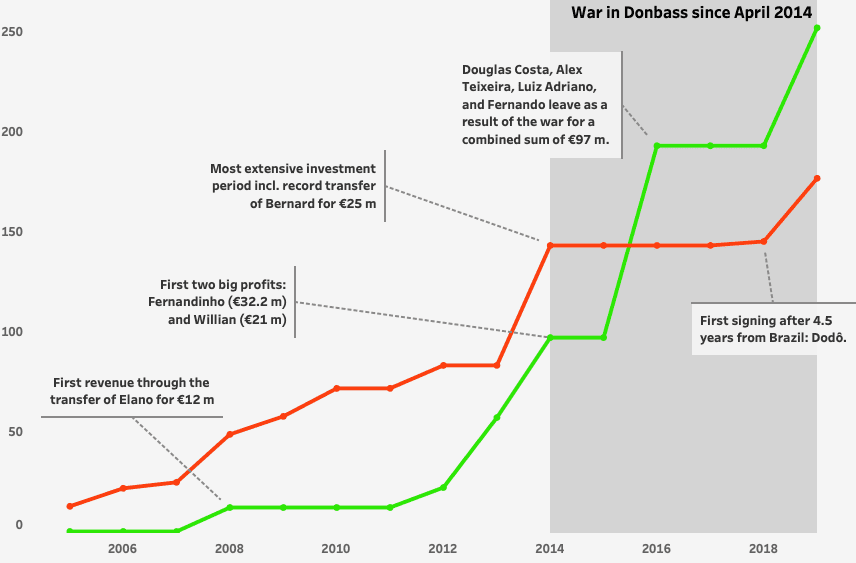

The influence of the war

There is a lot of randomness in football and the world in general. Sometimes, it is just bad luck, which jeopardises your whole business model. This is what happened to Shakhtar Donetsk when the Russian military intervention in Ukraine started in 2014, and things drastically changed in many perspectives.

They were not able anymore to play their home games in their own Donbass Arena and had to bear significant financial losses. In light of the crisis and the deficit by playing in Lviv (now Kyiv), it became difficult to attract new talents and led to players being keen on leaving the club. A group of players even refused to return to Donetsk in summer 2014 and were eventually sold in summer 2015. This explains the enormous increase in revenue that year.

Due to these developments, it no longer seemed impossible that the Brazilian era would come to an end at Shakhtar. However, in January 2018, Dodo was the first player that moved do Donetsk followed by six more in recent transfer windows. The sale of Fred to Manchester United also played a key role in this regard as it allowed more financial leeway to refresh the squad.

What’s next?

Overall, Shakhtar have laid the foundation to rejuvenate their ageing squad as they acquired young prospects for all parts of their team. Nevertheless, especially in the attack, they still rely a lot on their older stars Taison, Marlos, and Junior Moraes. All of them are over 30 but still indispensable and the most prolific scorers. Of the previous purchases, Tete and Fernando are offensive players and might replace them. Fernando has just scored his first goal for Shakhtar after he hardly saw any playing time since his arrival in 2018.

Marlos, Taison, and Junior Moraes might have one or two more great seasons in them, but their contracts end in 2021 and even if all youngsters develop well, their offensive options would be limited. Therefore, one can still expect Shakhtar to seek for another offensive player.

I don’t expect them to change their strategy and their focus on Brazilian talents even though a slight adaption might be worth a consideration. Brazilian talents attract attention from all over the world, which consequently raises the prices. This is definitely a disadvantage from Shakhtar’s point of view due to their financial constraints from operating in a small market and political uncertainty.

That said, there are other leagues with talented players who might be available at a cheaper price. Shakhtar already showed that they can become creative and ready to slightly deviate from their general strategy with the signing of the Israeli Manor Solomon. Perhaps, in the long-term, a third recruitment path next to the Ukrainians and Brazilians could help them to become more flexible and fish from an even larger pool of talent. Adding to this, also partnerships with other clubs to create synergies in terms of talent identification, sharing of transfer knowledge, or other important areas could bring significant advantages.

Howsoever, the next U20 World Cup and U20 South American Championship take place next year…

Conclusion

Shakhtar Donetsk’s recruitment strategy is much more complex than we were able to examine in this analysis. However, we’ve seen some interesting facts, particularly their attached importance to U20-tournaments and their new tendency to sign Brazilians without any experience on a professional level. Furthermore, we have classified their signings into three categories and seen that some just need more time to adapt than others. To sum it up, Shakhtar have implemented a very successful business model for 15 years that allows them to compete against Europe’s elite while earning significant profits

Comments